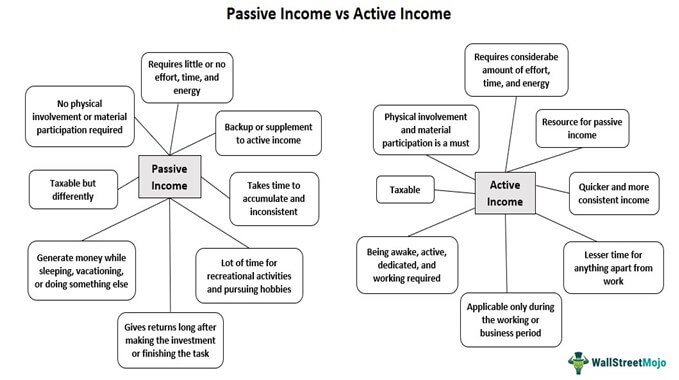

Residual income is the key to achieving financial freedom and building a life where your money works for you. Unlike traditional income, which relies on active effort, residual income allows you to earn continuously from investments or ventures you’ve already set up. Whether it’s through real estate, dividends, or innovative platforms like Remixable, creating residual income streams is more accessible than ever.

In this guide, we’ll dive into everything you need to know about residual income, explore various methods to generate it, and discuss how tools like Remixable can simplify the process. If you’re ready to transform your financial future, let’s get started!

Table of Contents

What is Residual Income?

Residual income, often called passive income, is income earned with little to no ongoing effort after the initial setup. Examples include royalties from a book, rental income from properties, or subscriptions from digital products.

Why is it important?

Residual income allows you to:

- Gain financial independence.

- Diversify income sources.

- Reduce reliance on active work hours.

1. Real Estate Investments

Real estate is one of the most reliable and popular methods for creating residual income. You can invest in:

- Rental Properties: Earn consistent monthly income by renting out residential or commercial spaces.

- Real Estate Investment Trusts (REITs): Invest in REITs to earn dividends without owning or managing properties.

Pros:

- High earning potential with property value appreciation.

- Tangible asset security.

Cons:

- High initial investment and maintenance costs.

- Property management can be time-consuming unless outsourced.

Example:

Owning a $250,000 rental property and charging $1,500 monthly rent can result in $18,000 annual gross income, minus expenses for management, repairs, and taxes.

2. Stock Dividends

Investing in dividend-paying stocks can be a hands-off way to generate residual income. Companies distribute a portion of their profits to shareholders as dividends.

Pros:

- Steady income source, especially with blue-chip stocks.

- Potential for long-term capital appreciation.

Cons:

- Market volatility can affect dividend payouts.

- Requires significant initial capital for meaningful returns.

Example:

Investing $10,000 in a stock with a 5% annual dividend yield could generate $500 in annual income, which grows with reinvestments and compounding.

3. Remixable: Your Gateway to Digital Residual Income

Remixable is an innovative cloud-based software designed for entrepreneurs and marketers seeking to create, rebrand, and sell software products effortlessly. It combines cutting-edge tools with automation, making it ideal for building a sustainable residual income stream.

How Remixable Works

- Create Unique Software Products: Use the software generator to build and customize products tailored to your niche.

- Rebrand and Resell: Repackage existing software under your brand and sell subscriptions or licenses.

- Leverage Marketing Tools: Utilize the built-in website builder, traffic generation resources, and content packs for rapid deployment.

Benefits of Remixable

- Low Barrier to Entry: No need for technical skills or a big budget.

- Scalable Model: Create unlimited software products, websites, and traffic streams.

- Automation: Save time with preloaded templates, niche content packs, and video creation tools.

Example Use Case

- Develop a project management tool using Remixable’s platform. Sell it as a monthly subscription service to businesses, creating a steady stream of residual income.

4. Affiliate Marketing

Affiliate marketing involves promoting products or services and earning a commission for each sale made through your referral link. Once your campaigns are set up, they can generate residual income with minimal effort.

Steps to Get Started:

- Choose a niche you are passionate about.

- Join affiliate programs like Amazon Associates, ShareASale, or ClickBank.

- Promote products using blogs, social media, or email marketing.

Pros:

- Minimal upfront investment.

- Scalable with automation tools like email autoresponders.

Cons:

- Requires time to build traffic and trust.

- Earnings depend on the affiliate program’s commission structure.

Example:

Promoting a $100 product with a 10% commission rate can earn you $10 per sale. If your blog attracts 1,000 visitors monthly with a 2% conversion rate, that’s $200 in residual income.

5. Online Course Creation

Creating and selling an online course is a lucrative way to generate residual income, especially if you’re an expert in a specific field. Platforms like Teachable, Udemy, and Thinkific make it easy to start.

Steps to Create an Online Course:

- Identify a high-demand topic in your niche.

- Create content using video lectures, PDFs, and quizzes.

- Market your course using social media, blogs, and email campaigns.

Pros:

- High earning potential with minimal ongoing effort.

- Provides value to a large audience.

Cons:

- Requires significant time and effort to develop the course initially.

- Marketing is essential to attract students.

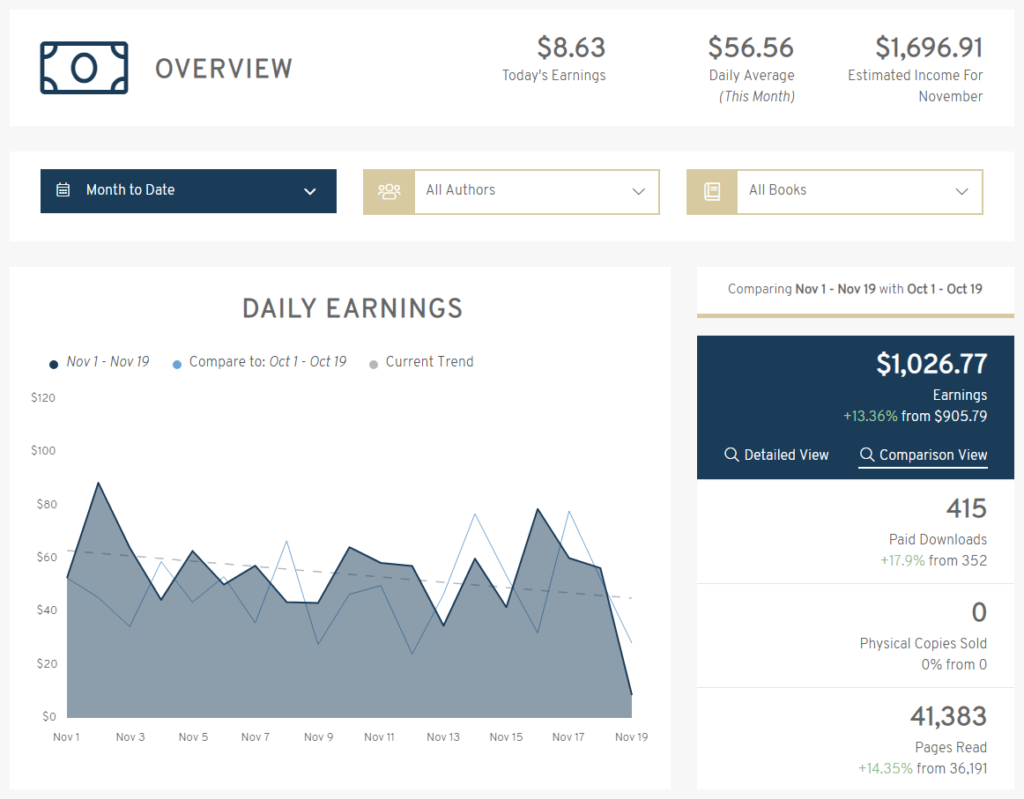

6. E-Book Publishing

Publishing e-books on platforms like Amazon Kindle Direct Publishing (KDP) can be a cost-effective way to generate residual income.

Steps to Publish an E-Book:

- Write a book in a niche with proven demand.

- Design a professional cover using tools like Canva or hire a designer.

- Upload to Amazon and set your price.

Pros:

- Passive income once published.

- Low upfront costs compared to traditional publishing.

Cons:

- Requires marketing to drive sales.

- Competitive market.

Conclusion

Building residual income streams is one of the most effective ways to secure financial freedom and create a stable income that works for you, even when you’re not actively working. By exploring opportunities such as real estate investments, stock dividends, affiliate marketing, e-book publishing, and leveraging tools like Remixable, you can craft a tailored strategy that aligns with your goals, skills, and resources.

Among the various methods, Remixable stands out as a revolutionary platform for digital entrepreneurs. It simplifies product creation, rebranding, and sales, empowering you to build your software business with minimal technical expertise. Whether you want to rebrand software or sell digital products, Remixable offers tools to help you scale and sustain a reliable source of residual income.

Key Takeaways:

- Start small and scale your efforts as you gain confidence and resources.

- Focus on strategies that complement your expertise and passions.

- Use tools like Remixable to streamline processes and maximize results.

Residual income isn’t just about making money; it’s about creating freedom and opportunities for the future. With patience, persistence, and the right tools, you can turn your residual income goals into a reality.

Ready to take the next step?

Explore how Remixable can revolutionize your journey to residual income today and start building your financial independence!

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!