Looking to make passive income in 2024? You’re not alone! Earning money with minimal effort has become a top goal for many, whether it’s to achieve financial freedom, create a safety net, or simply boost monthly cash flow. Passive income lets you earn while you focus on other aspects of life, giving you financial flexibility and independence.

In this guide, we’ll explore 15 effective ways to make passive income, covering options for every skill level and investment budget. From investments to digital products, discover strategies that can help you start building wealth with ease.

Table of Contents

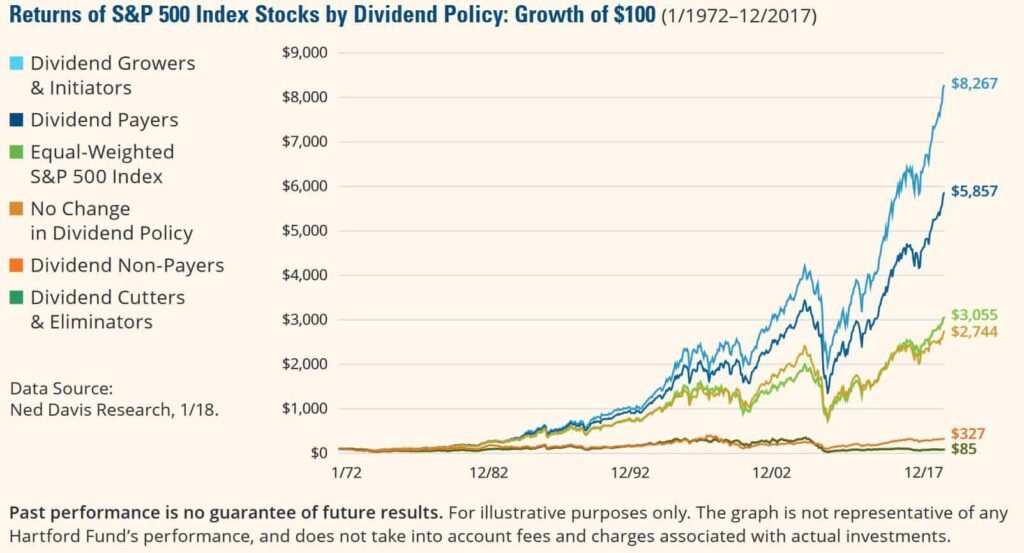

1. Dividend Stocks

Investing in dividend stocks is one of the simplest ways to earn passive income. Dividend stocks are shares of companies that pay out a portion of their earnings to investors regularly, typically every quarter. Large, stable companies in sectors like utilities, telecommunications, and consumer goods often pay steady dividends, making them reliable choices for passive income seekers.

How It Works: By purchasing shares, you become a part-owner of the company, entitling you to a share of its profits. Dividend payments are typically reinvested for compounding growth or used as a steady income source.

2. Real Estate Investment Trusts (REITs)

Real Estate Investment Trusts (REITs) allow you to invest in large-scale, income-generating real estate without directly buying property. REITs own, manage, or finance real estate, from office buildings and shopping centers to apartment complexes. They are publicly traded, so you can buy shares like you would with any stock. Most REITs pay out 90% of their taxable income to shareholders, making them an attractive choice for generating passive income.

How It Works: You purchase shares in a REIT, and in return, you receive a portion of the income generated by the real estate holdings. This is a hands-off approach to real estate investment.

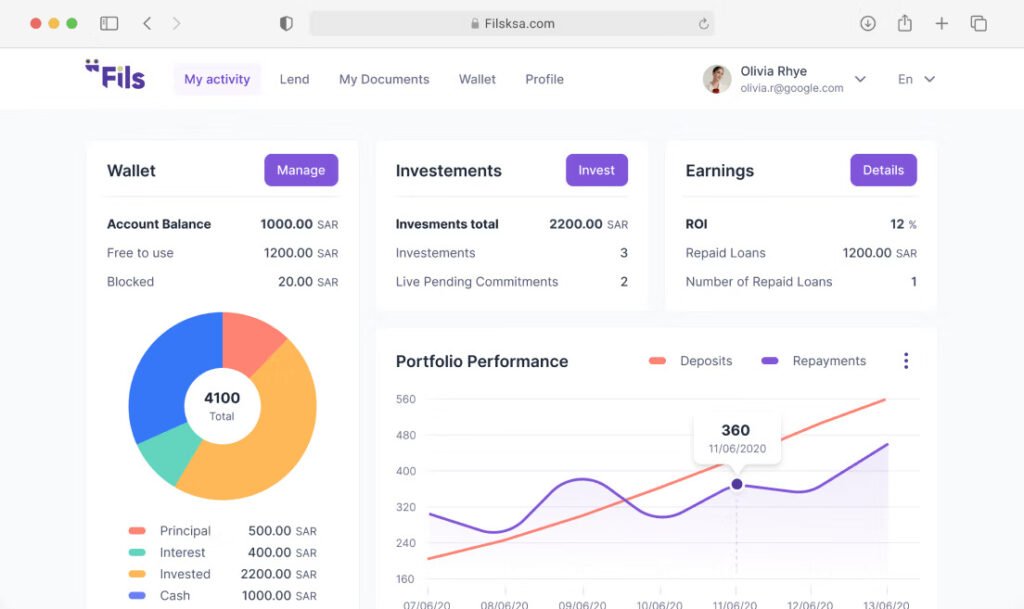

3. Peer-to-Peer (P2P) Lending

With Peer-to-Peer (P2P) lending, you lend money directly to individuals or businesses via online platforms and earn interest on these loans. P2P lending offers higher interest rates than traditional savings accounts, but it comes with risk, as some borrowers may default. However, most P2P platforms allow you to diversify by investing small amounts in multiple loans to spread the risk.

How It Works: After choosing a P2P lending platform, you can browse borrower profiles and select loans to invest in. As borrowers repay, you receive interest, making this a potentially lucrative passive income stream.

4. Rental Properties

Owning rental properties is a traditional but effective way to generate passive income. By purchasing real estate and renting it out, you can earn a consistent income through monthly rent payments. Although managing tenants and property upkeep requires some work, hiring a property manager can make this a passive investment.

How It Works: After buying a property, you rent it to tenants, who pay you monthly. Property appreciation can increase your earnings over time, and tax benefits on mortgage interest and expenses can improve profitability.

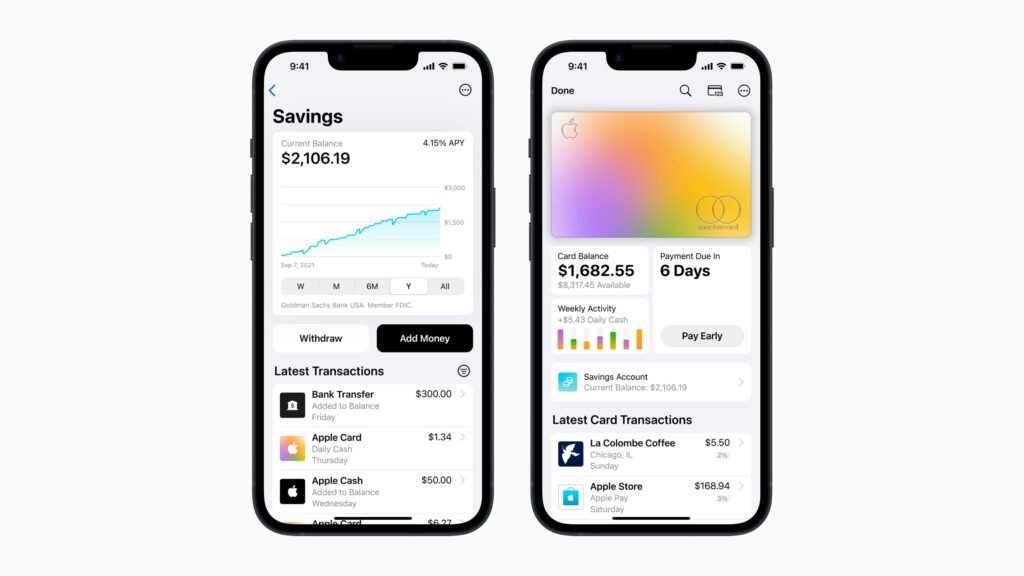

5. High-Yield Savings Accounts and CDs

High-yield savings accounts and Certificates of Deposit (CDs) are low-risk options for passive income. High-yield savings accounts offer interest rates higher than traditional savings accounts, while CDs lock in your money for a specific term with a fixed interest rate. Both options are ideal if you’re looking for safe ways to earn passive income, though returns are typically lower than other methods.

How It Works: With a high-yield savings account, your money is accessible anytime, while a CD requires you to keep your funds in the account for the term’s duration. Interest is compounded and credited to your balance, growing over time.

6. Create and Sell Digital Products

Selling digital products such as e-books, courses, printables, or stock photos is an excellent way to earn passive income. Once you create and upload the product, it can be sold repeatedly without additional effort. Platforms like Etsy, Udemy, and Amazon Kindle Direct Publishing make it easy to reach customers.

How It Works: Choose a niche or topic, create valuable digital content, and list it on a platform. For every sale, you receive a portion of the proceeds, allowing you to earn continuously without ongoing involvement.

7. Affiliate Marketing

Affiliate marketing allows you to earn commissions by promoting other companies’ products or services. You can share affiliate links on your blog, social media, or website, and whenever someone makes a purchase through your link, you earn a percentage of the sale. Affiliate marketing can be an effective passive income source, especially for those with an established online audience.

How It Works: Sign up for affiliate programs related to your niche, promote their products, and earn commissions on each sale. It’s essential to choose products you genuinely recommend to build trust with your audience.

8. Create a Blog or YouTube Channel

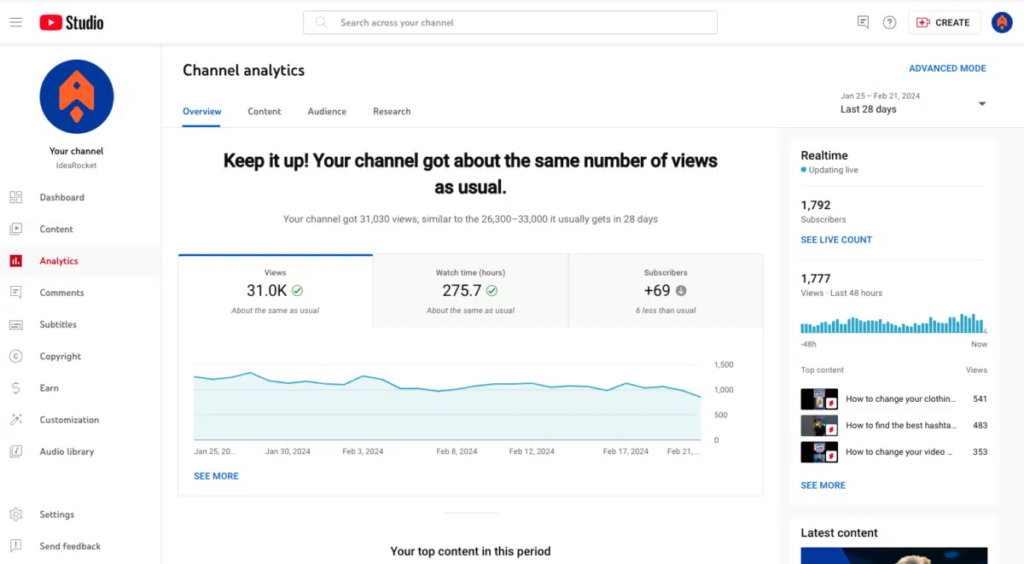

Starting a blog or YouTube channel can generate passive income through ads, sponsored posts, and affiliate marketing. Though it requires time and effort initially, a successful blog or channel can bring in revenue long-term, even as old posts or videos continue to attract viewers.

How It Works: Choose a topic you’re passionate about, consistently create valuable content, and monetize your platform through ad networks like Google AdSense or affiliate links. As your audience grows, so does your earning potential.

9. Sell Stock Photos or Art

If you have a knack for photography or art, you can sell stock photos or digital art on platforms like Shutterstock or Adobe Stock. These platforms pay you every time someone downloads one of your images. This method is especially effective for photographers or artists who can regularly create and upload new work.

How It Works: Upload your best photos or designs, and whenever someone licenses your work, you earn royalties. Some images can continue to generate income for years.

10. Invest in Index Funds or ETFs

Investing in index funds or exchange-traded funds (ETFs) is one of the simplest and most reliable ways to make passive income. These funds pool money from multiple investors to invest in a diversified portfolio of stocks or bonds, often tracking a specific market index like the S&P 500.

Because they cover a broad range of assets, index funds and ETFs provide instant diversification, reducing risk compared to buying individual stocks. They also tend to have lower fees and require minimal management.

How It Works: Once you invest, index funds and ETFs passively grow in value as the market performs, with potential dividends paid out quarterly. You can opt to reinvest dividends to take advantage of compounding returns or receive them as cash for passive income.

Conclusion

Building a reliable passive income stream can transform your financial future, offering stability, flexibility, and even the potential for financial freedom. By choosing the right strategies, you can make passive income a steady part of your life without the need for constant involvement. Whether you’re investing in dividend stocks, exploring digital products, or diving into real estate, each option has unique benefits and potential risks.

To start, consider your current resources—both time and money—as well as your long-term financial goals. Some strategies, like dividend stocks or high-yield savings accounts, offer lower returns but are low-risk and easy to set up. Others, like rental properties or online content creation, may require more time and investment upfront but can yield substantial returns over time.

The key to success with passive income is consistency, diversification, and patience. By spreading your efforts across a few different methods, you can balance risk and reward while creating a sustainable income stream that grows with you. As you explore these ideas in 2024, remember that every small step you take today can lead to significant financial rewards in the future. Start small, stay committed, and watch your passive income grow!

Ready to Start Earning Passive Income? Join Our Free Webinar!

Learn expert tips, proven strategies, and actionable steps to start building passive income streams today. Don’t miss out on this opportunity to create financial freedom!

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!