Looking to earn money while you sleep? Passive income investments can help you generate steady revenue with minimal ongoing effort. In this blog post, we’ll explore the top 10 passive income investments for 2024, comparing their benefits, risks, and earning potential.

Whether you’re new to investing or a seasoned pro, these options offer something for everyone, helping you build a diversified portfolio and maximize your earnings with little day-to-day involvement. Let’s dive into the best ways to make your money work for you this year!

Table of Contents

1. Dividend Stocks

Dividend-paying stocks are a tried-and-true strategy for generating passive income. By investing in companies that pay dividends, you earn regular payments just for holding their shares. Large, established companies, known as “blue chips,” often pay reliable dividends and have a long track record of growth.

Why Choose Dividend Stocks?

- Steady Income: Dividends are typically paid quarterly, providing consistent cash flow.

- Capital Appreciation: In addition to dividends, your investment can grow in value as the stock price increases.

- Risk Factor: Stocks are inherently risky, but investing in dividend-paying companies with strong fundamentals can mitigate this.

2. Real Estate Crowdfunding

Real estate crowdfunding platforms allow you to invest in properties with small amounts of capital—sometimes as little as $500. Instead of buying property outright, you pool money with other investors to purchase commercial or residential real estate, which is managed by professionals.

Why Choose Real Estate Crowdfunding?

- Accessibility: Unlike traditional real estate investments, you don’t need large sums of money to get started.

- Diversification: You can invest in multiple properties across different markets, spreading your risk.

- Risk Factor: There’s some liquidity risk, as real estate crowdfunding investments often have fixed terms, during which your money is locked in.

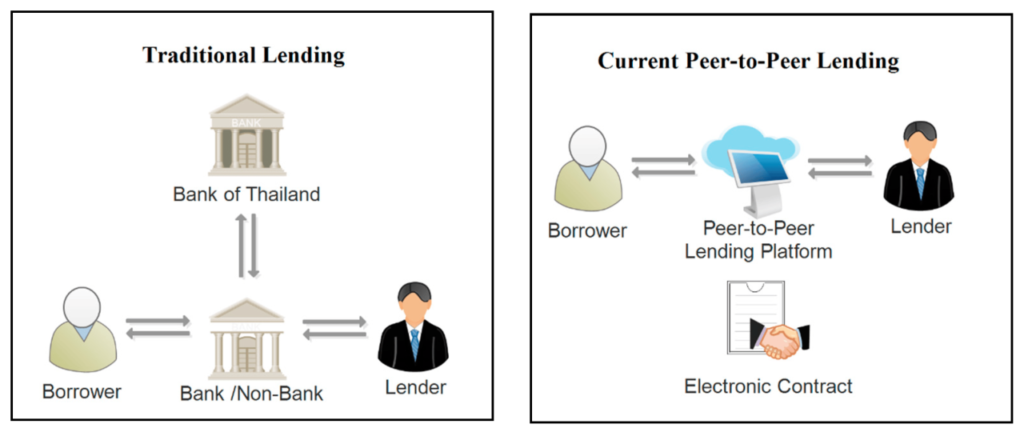

3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms allow you to lend money directly to borrowers and earn interest on the loans. These platforms act as intermediaries, connecting lenders with individuals or small businesses seeking loans.

Why Choose P2P Lending?

- High Returns: P2P loans typically offer much higher interest rates than savings accounts or bonds.

- Low Entry Barrier: You can start with small amounts of money, usually around $25 per loan.

- Risk Factor: Borrower default is the primary risk. It’s essential to diversify your loans across many borrowers to reduce risk.

4. High-Yield Savings Accounts

Though not the most exciting, high-yield savings accounts are one of the safest ways to earn passive income. These accounts offer higher interest rates than standard savings accounts and are ideal for those who want a no-risk option.

Why Choose High-Yield Savings Accounts?

- Safety: These accounts are FDIC-insured, meaning your money is protected up to $250,000.

- Liquidity: You can withdraw your funds at any time, making this one of the most flexible options.

- Risk Factor: The biggest downside is the relatively low returns compared to other passive income options.

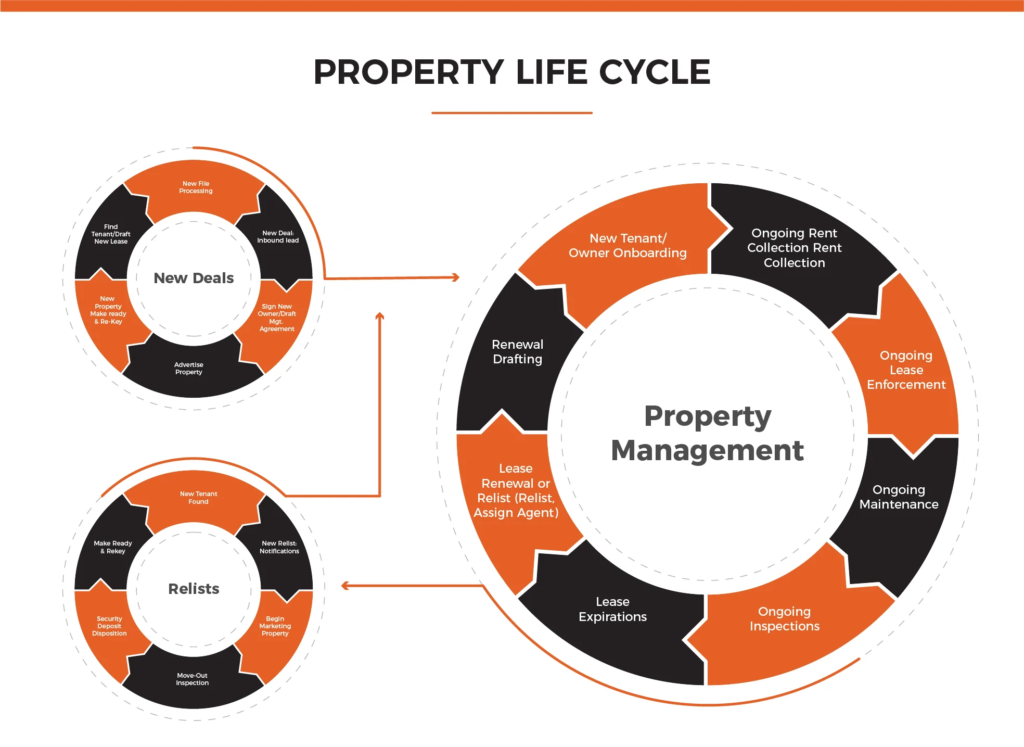

5. Rental Properties (Managed)

Owning rental properties can be a lucrative passive income stream if you delegate the day-to-day management to a property manager. While this requires a larger upfront investment, rental income can be steady and relatively predictable.

Why Choose Managed Rental Properties?

- Consistent Income: Rent is a reliable source of income, especially in high-demand areas.

- Appreciation Potential: Over time, real estate tends to increase in value, providing you with both rental income and capital gains.

- Risk Factor: Real estate markets can fluctuate, and vacancies or unexpected repairs can reduce profitability.

6. REITs (Real Estate Investment Trusts)

A REIT is a company that owns or finances income-producing real estate in various sectors, such as residential, commercial, or industrial. By investing in a REIT, you get the benefits of real estate ownership without the need for large capital or hands-on management.

Why Choose REITs?

- Liquidity: REITs are traded on major stock exchanges, so you can buy or sell shares easily.

- Income: REITs are required to pay out at least 90% of their taxable income as dividends, making them a reliable source of passive income.

- Risk Factor: Like stocks, the price of REIT shares can fluctuate, and the value of the underlying real estate can be affected by market trends.

7. Create and Sell Digital Products

Creating digital products, such as eBooks, online courses, or printables, can be a highly scalable form of passive income. Once created, these products can be sold repeatedly without the need for additional effort. Platforms like Gumroad or Teachable make it easy to host and sell digital content.

Why Choose Digital Products?

- High Margins: After the initial creation, most of the income generated is profit.

- Scalability: You can reach a global audience and make sales 24/7.

- Risk Factor: While the upfront work can be intense, the risk lies in whether there’s enough demand for your product.

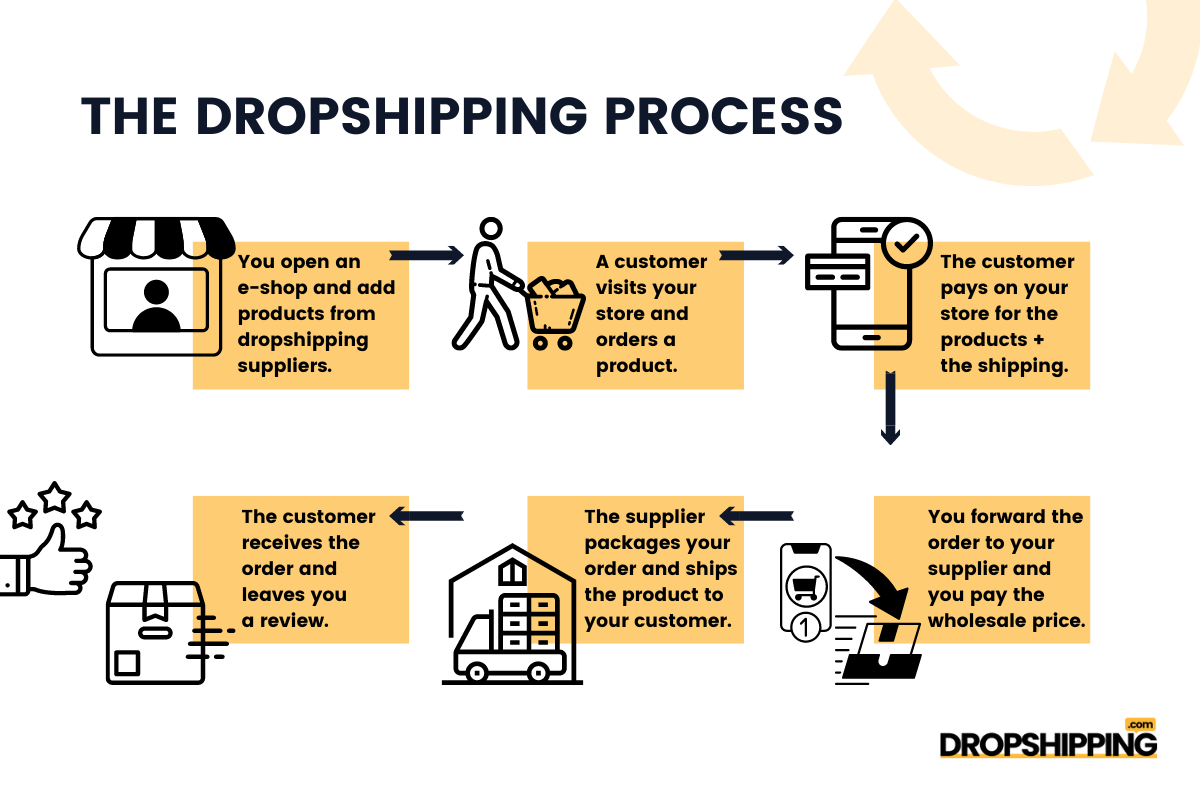

8. Automated Online Businesses

Running an online business—like a drop-shipping store or affiliate website—can be an excellent passive income stream when automated correctly. Tools like Shopify or WordPress can help set up a business that requires minimal ongoing maintenance.

Why Choose Automated Online Businesses?

- Potential for High Returns: Once set up, an online business can generate significant revenue with little intervention.

- Automation: Many aspects of an online business, from order fulfillment to customer service, can be automated using tools and software.

- Risk Factor: Like all businesses, online ventures carry risks, such as market competition and changing consumer trends.

9. Bonds and Bond Funds

Bonds are debt instruments that pay periodic interest to investors in exchange for a loan to governments, municipalities, or corporations. While bonds don’t offer sky-high returns, they are relatively safe and can be a valuable part of a diversified portfolio.

Why Choose Bonds?

- Stability: Bonds, especially government bonds, are considered low-risk investments.

- Fixed Income: Bondholders receive regular interest payments, making it a predictable source of passive income.

- Risk Factor: The primary risk is inflation, which can erode the value of bond returns over time.

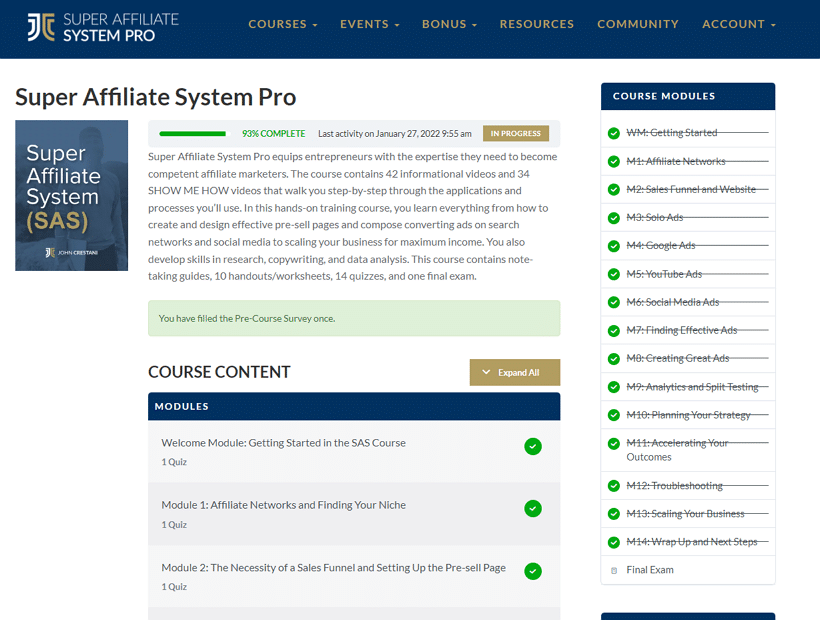

10. Affiliate Marketing

Affiliate marketing allows you to earn commissions by promoting other companies’ products through blogs, social media, or websites. Once you’ve built an audience, this can be a highly profitable source of passive income, especially if you focus on evergreen products.

One of the standout programs in the affiliate marketing world is John Crestani’s Super Affiliate System, a comprehensive training program designed to teach you how to become a successful affiliate marketer. This system focuses on scaling your business through paid traffic and offers step-by-step guidance for beginners and experts alike.

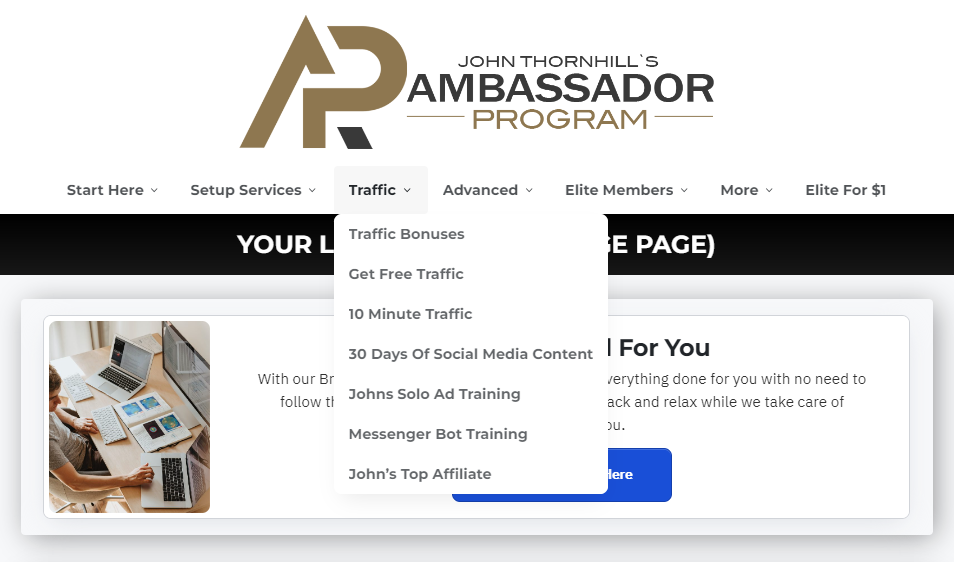

In addition, John Thornhill’s Ambassador Program is another powerful affiliate marketing opportunity, where you not only promote his high-quality products but also earn commissions by referring others to become ambassadors. This program is designed to create recurring passive income streams with a focus on digital products and training courses.

Why Choose Affiliate Marketing?

- Scalable: The more traffic you drive, the more you can earn.

- Low Upfront Cost: You can start affiliate marketing with little to no investment, using free platforms like YouTube or Instagram.

- Risk Factor: The challenge is driving enough traffic and finding the right products to promote. It can take time to build a loyal audience.

How to Choose the Right Passive Income Investment for You

When choosing from the top passive income investments for 2024, consider the following factors:

- Your Risk Tolerance: Dividend stocks and P2P lending can offer higher returns, but they come with more risk. Safer options like bonds and high-yield savings accounts offer lower returns but less volatility.

- Your Available Capital: Some investments, like real estate or rental properties, require a larger upfront investment, while others, like P2P lending or digital products, can be started with smaller amounts.

- Your Time Commitment: Consider how much time you want to spend managing your investments. Some options, like creating digital products, may require more upfront work, while others, like high-yield savings accounts or REITs, require little ongoing effort.

Conclusion

Building passive income is a powerful way to achieve financial freedom and create long-term wealth. The top 10 passive income investments for 2024 offer a wide range of opportunities for different types of investors, from those looking for stable, low-risk returns to those seeking higher potential earnings with some risk. By carefully considering your risk tolerance, time commitment, and available capital, you can choose the investments that align best with your financial goals.

Whether you prefer the steady payouts from dividend stocks, the ease of real estate crowdfunding, or the flexibility of creating digital products, there’s an option that can fit into your passive income strategy. Diversifying across several of these investments can help you reduce risk and create multiple income streams, ensuring you maximize your earnings with minimal effort.

To get started, take a closer look at each of these investment opportunities, consider your personal financial situation, and begin building your passive income portfolio today. With the right approach, you can turn your investments into a reliable source of income that works for you in 2024 and beyond.

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!