In this comprehensive guide, we compare the top business credit builders to help you find the perfect fit for your business. Whether you’re a small startup or an established company, selecting the right business credit builder can significantly impact your financial health and growth potential. Let’s explore the best options available in 2024 to ensure your business thrives.

Table of Contents

Understanding Business Credit Builders

What is a Business Credit Builder?

A business credit builder is a service or tool that helps businesses establish and improve their credit profiles by reporting to credit bureaus, offering credit accounts, and providing credit monitoring services.

Key Benefits:

- Improved Credit Score: Regular reporting to major credit bureaus.

- Better Financing Options: Access to loans with favorable terms.

- Enhanced Credibility: Strengthened trust with suppliers and partners.

Key Features to Look For

- Ease of Use

- User-friendly interface and easy navigation.

- Accessible via multiple devices.

- Credit Reporting

- Reports to major credit agencies like Experian, Dun & Bradstreet, and Equifax.

- Frequency of reporting (monthly, quarterly).

- Credit Account Options

- Variety of credit accounts (trade lines, credit cards).

- Flexibility in terms of usage and repayment.

- Pricing and Fees

- Transparent subscription costs.

- Absence of hidden fees.

- Customer Support

- Availability (24/7, weekdays).

- Multiple support channels (phone, email, chat).

Comparison of Top Business Credit Builders

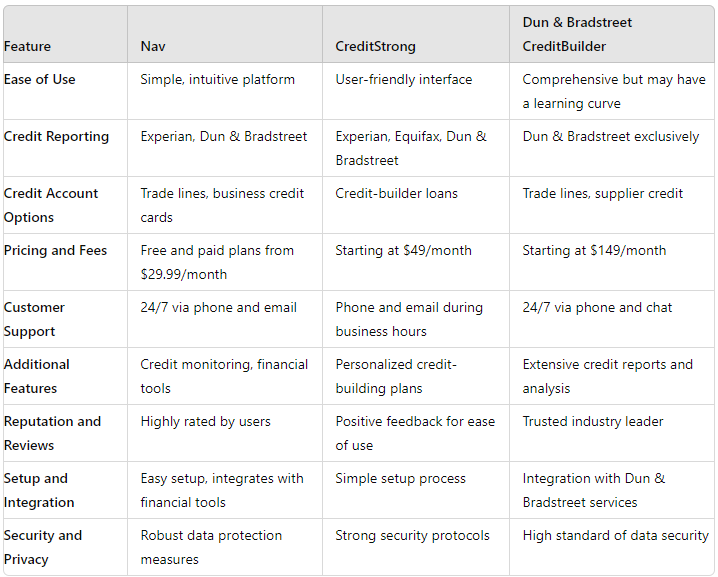

1. Nav

Ease of Use: Nav offers a simple and intuitive platform that’s easy to navigate.

Credit Reporting: Reports to Experian and Dun & Bradstreet.

Credit Account Options: Provides access to various trade lines and business credit cards.

Pricing and Fees: Offers both free and paid plans, with the paid plans starting at $29.99/month.

Customer Support: 24/7 support via phone and email.

2. CreditStrong

Ease of Use: User-friendly interface with clear instructions.

Credit Reporting: Reports to all three major credit bureaus.

Credit Account Options: Offers credit-builder loans specifically designed for businesses.

Pricing and Fees: Starts at $49/month with no hidden fees.

Customer Support: Available via phone and email during business hours.

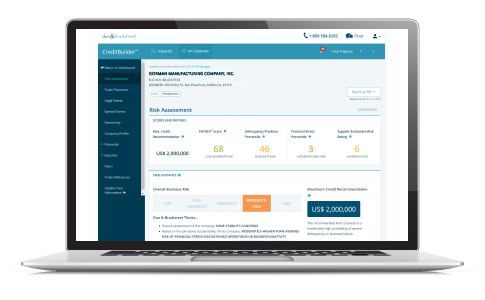

3. Dun & Bradstreet CreditBuilder

Ease of Use: Comprehensive platform, though it may have a learning curve for new users.

Credit Reporting: Exclusively reports to Dun & Bradstreet.

Credit Account Options: Focuses on trade lines and supplier credit.

Pricing and Fees: Starting at $149/month.

Customer Support: 24/7 support via phone and chat.

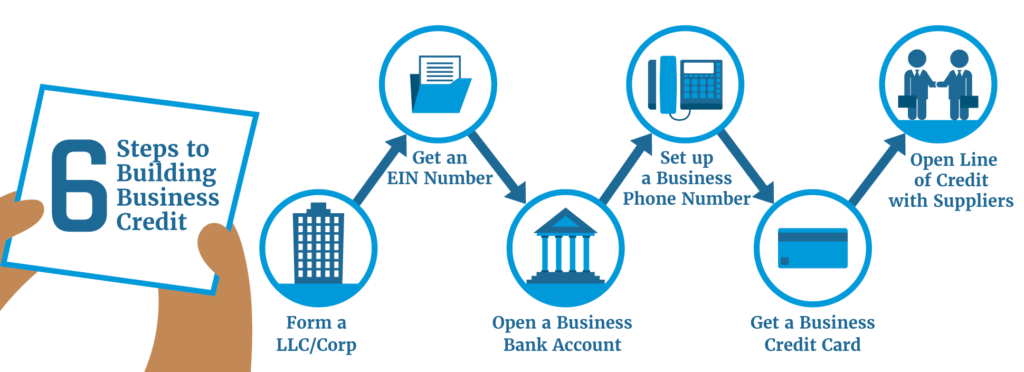

How to Choose the Right Business Credit Builder for Your Business

Assess Your Business Needs: Determine whether you need comprehensive credit reporting, specific types of credit accounts, or advanced monitoring features.

Match Features with Requirements: Compare the features of each business credit builder to your specific needs. For example, if you need robust customer support, prioritize services known for their excellent support teams.

Making the Final Decision: Consider starting with a trial or free plan to evaluate the service. Review user feedback and testimonials to ensure the service meets your expectations.

You may wish to wish to download this Free Guide to unlocking the hidden credit secret to $1 million dollar.

Conclusion

Choosing the right business credit builder is a pivotal decision that can significantly impact your business’s financial health and growth potential. By understanding your specific needs and thoroughly comparing the available options, you can select a business credit builder that aligns with your goals and budget.

A robust business credit profile not only opens doors to better financing options but also enhances your business’s credibility with suppliers and partners. Whether you opt for a service like Nav with its user-friendly interface and affordable plans, or Dun & Bradstreet CreditBuilder with its comprehensive trade line focus, the key is to ensure that the chosen service effectively reports to the major credit bureaus and provides the necessary support to help your business thrive.

Remember, the process of building business credit takes time and consistent effort. Regularly monitoring your credit profile, utilizing the available credit accounts responsibly, and staying informed about your credit standing are essential practices for maintaining a strong business credit score.

By taking proactive steps and leveraging the right business credit builder, you can secure the financial future of your business, making it resilient and poised for growth in the competitive market.

Thank you for reading my comprehensive guide on business credit builders. I hope this information helps you find the perfect fit for your business and leads you to greater financial success.

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!