Looking for easy passive income ideas to boost your earnings in 2024? Whether you’re aiming for financial freedom or just want to supplement your current income, there are plenty of simple and effective ways to generate money with minimal effort.

In this post, we’ll explore 10 of the best passive income strategies that can help you start earning while you sleep—no complex skills or massive investments required! Read on to discover how you can create steady, hands-off income streams and take control of your financial future.

Table of Contents

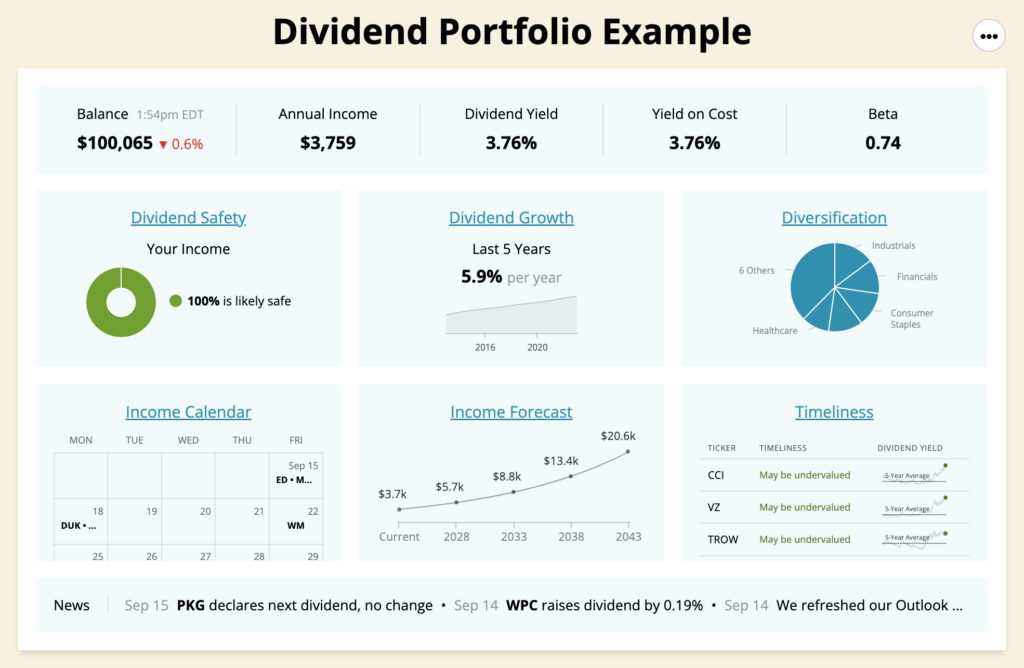

1. Dividend-Paying Stocks

One of the simplest ways to earn passive income is through dividend-paying stocks. These are stocks from companies that regularly share their profits with investors in the form of dividends. All you have to do is invest in the right stocks and hold onto them, allowing you to earn consistent income over time. Many people reinvest their dividends to benefit from compound growth.

- Initial Investment Required: Medium to high, depending on the stock

- Earning Potential: Moderate to high, with long-term growth

- Effort to Maintain: Very low once invested

For example, if you invest in a company like Coca-Cola or Apple, which have a history of paying dividends, you can expect quarterly payouts. Over time, you can grow your dividend income by reinvesting it into more shares.

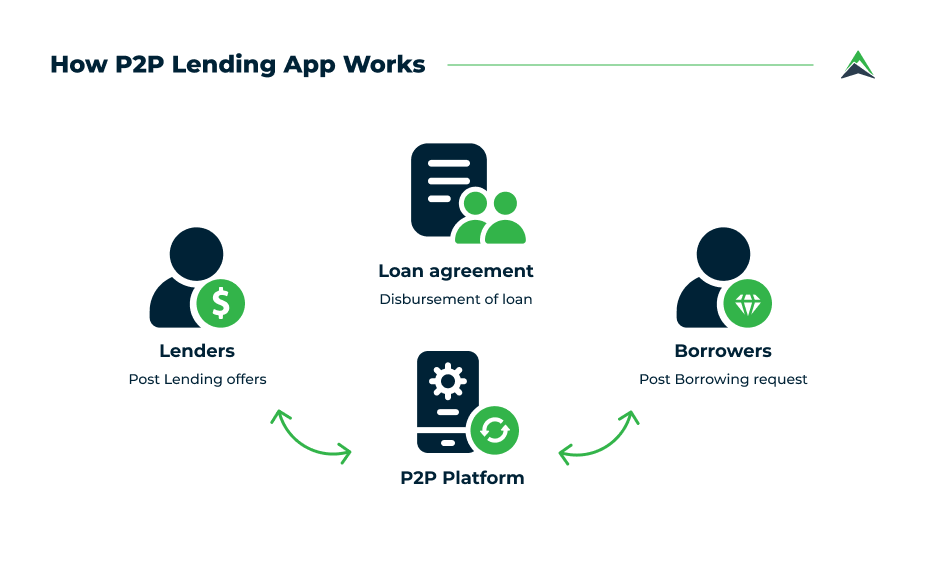

2. Peer-to-Peer Lending

Peer-to-peer lending (P2P) allows you to act as a lender and loan your money to individuals or businesses through platforms like LendingClub or Prosper. In return, you earn interest on the money you lend.

This is an easy passive income stream because once you’ve made the loan, you’ll receive monthly payments until the loan is repaid, and your profit comes from the interest.

- Initial Investment Required: Low to medium (you can start with as little as $25 per loan)

- Earning Potential: Moderate; interest rates typically range from 5% to 12%

- Effort to Maintain: Minimal—just monitor repayments

Keep in mind that while you can earn good returns, there is a small risk involved as not all borrowers may repay their loans.

3. Real Estate Crowdfunding

If traditional real estate investing seems daunting or requires more capital than you can afford, consider real estate crowdfunding. Platforms like Fundrise or RealtyMogul allow you to pool funds with other investors to purchase real estate, such as apartment complexes, commercial buildings, or development projects. You earn money from rental income or property value appreciation without the need to be a landlord.

- Initial Investment Required: Low to medium (many platforms allow you to start with as little as $500)

- Earning Potential: Moderate to high; expect 8%-12% annual returns

- Effort to Maintain: Low, as you’re a passive investor

This is a great option for those who want to benefit from real estate without dealing with tenants, maintenance, or large upfront investments.

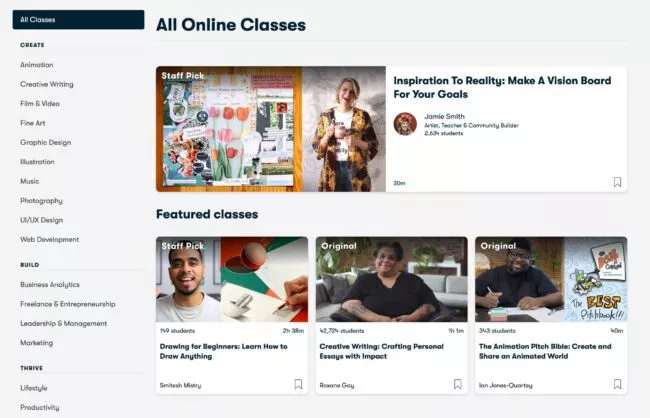

4. Create an Online Course

If you have expertise in a specific field, creating an online course can generate substantial passive income. Once the course is built and uploaded to platforms like Udemy, Teachable, or Skillshare, it can keep generating revenue for months or even years as students continue to enroll.

- Initial Investment Required: Low; requires time to create, but monetary investment is minimal

- Earning Potential: High, depending on demand for your course

- Effort to Maintain: Low after the course is created (may require periodic updates)

For example, if you’re skilled in graphic design, you could create a course teaching beginners the basics of using Adobe Photoshop. Each time someone buys your course, you earn money without additional effort.

5. Affiliate Marketing

Affiliate marketing allows you to earn a commission by promoting other companies’ products or services.

When someone makes a purchase through your referral link, you earn a percentage of the sale. This can be done through blog posts, YouTube videos, or social media.

- Initial Investment Required: Low (may involve creating content or building a website)

- Earning Potential: Moderate to high, depending on traffic and conversions

- Effort to Maintain: Low to medium; requires content creation initially

For example, if you have a blog about tech gadgets, you can include affiliate links to Amazon products. Whenever your readers buy the products you recommend, you earn a small commission.

6. Sell Digital Products

Digital products like eBooks, printables, or templates are a great way to earn passive income. Once you create a product, you can sell it on platforms like Etsy, Gumroad, or your own website. Since digital products don’t require shipping or inventory, they are easy to manage once they’re listed.

- Initial Investment Required: Low (primarily time to create the product)

- Earning Potential: Moderate to high

- Effort to Maintain: Very low once created and listed

For instance, a photographer might create and sell Lightroom presets, or a writer might sell an eBook on self-improvement.

7. Rent Out Your Space

If you own a property or even just a spare room, you can earn passive income by renting it out. Platforms like Airbnb and Vrbo make it easy to list your space and start earning money from travelers or renters. Even renting out a garage, storage space, or parking spot can provide a steady stream of income.

- Initial Investment Required: Low to medium (depends on whether the space needs preparation)

- Earning Potential: Moderate to high, depending on location and demand

- Effort to Maintain: Medium, as you’ll need to handle bookings and cleaning

8. Invest in a High-Yield Savings Account or CDs

If you’re risk-averse and looking for a super-safe way to generate easy passive income, investing in high-yield savings accounts or Certificates of Deposit (CDs) is a smart option. While the returns are relatively low compared to other options, they are guaranteed and involve zero risk.

- Initial Investment Required: Low to medium (depending on deposit size)

- Earning Potential: Low (1% to 4% annual returns)

- Effort to Maintain: Very low; just let your money sit and grow

This method is ideal for those who want steady, guaranteed returns with no risk of loss.

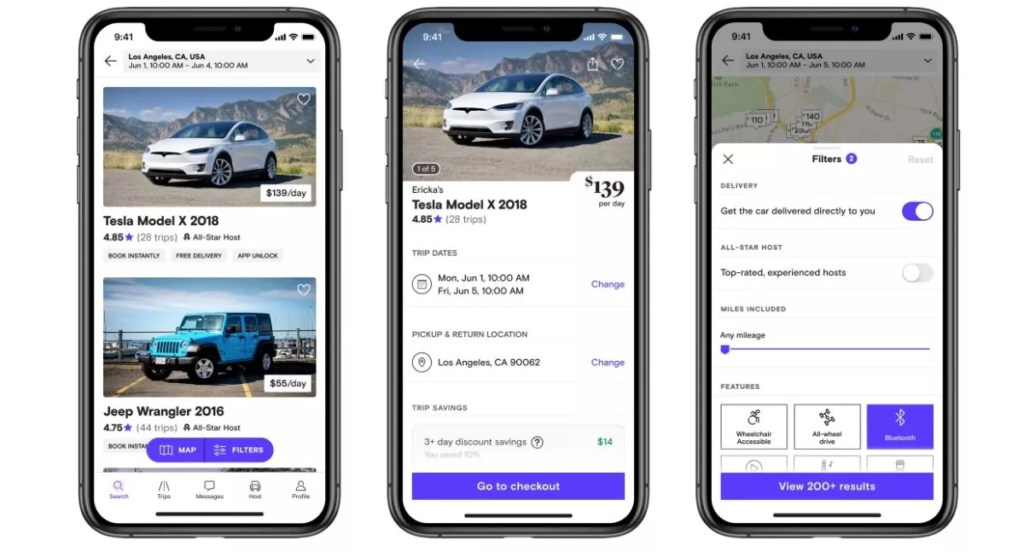

9. Rent Out Your Car

Platforms like Turo or Getaround allow you to rent out your car when you’re not using it. Instead of letting your car sit idle in the driveway, you can make passive income by renting it to people in your area.

- Initial Investment Required: Low to medium (if you already own a car)

- Earning Potential: Moderate, depending on how often the car is rented

- Effort to Maintain: Medium; includes managing rentals and maintenance

10. Invest in Index Funds

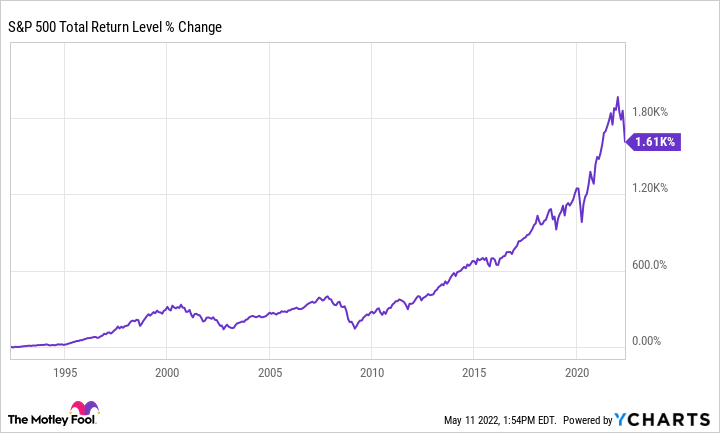

Index funds are a hands-off way to invest in the stock market without needing to pick individual stocks.

These funds automatically track the performance of a market index, such as the S&P 500, and grow over time as the market rises.

- Initial Investment Required: Medium

- Earning Potential: Moderate to high, depending on market performance

- Effort to Maintain: Very low, as they are fully managed

Index funds are perfect for long-term, passive investors who want steady growth without constant monitoring.

Conclusion

Building passive income streams in 2024 doesn’t have to be complicated. By exploring these 10 easy passive income ideas, you can start earning extra income with minimal effort and investment. Whether you’re interested in dividend-paying stocks, real estate crowdfunding, or even selling digital products, there’s an option that can suit your goals and lifestyle.

The key to success with passive income is starting small and scaling as you learn more about each method. The sooner you take action, the sooner you’ll begin seeing the rewards. Remember, not all passive income streams are completely hands-off at the beginning, but with time and the right approach, many can turn into reliable, ongoing sources of income.

Now is the perfect time to take the next step towards financial freedom. Choose one or two strategies from this list, get started, and let your money work for you. The potential to grow your earnings and achieve long-term financial security is within your reach.

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!