Looking for the best ways to make passive income in 2024? Whether you’re aiming to achieve financial freedom, build wealth, or simply boost your earnings without putting in constant effort, passive income can be the key.

In this guide, we’ll explore the top 10 methods that can help you earn money while you sleep—covering everything from dividend stocks to real estate crowdfunding. Discover which passive income strategy fits your lifestyle, budget, and goals, and start making your money work for you!

Let’s explore each method, comparing the investment, effort, and risks involved.

Table of Contents

1. Dividend Stocks

Investing in dividend-paying stocks is one of the oldest and most reliable ways to earn passive income. When you buy shares in a company that pays dividends, you receive a portion of their profits regularly—often every quarter. This can provide a steady income stream, especially if you reinvest your dividends to purchase more shares.

- Initial Investment Required: Moderate to high (depends on stock prices)

- Risk Level: Medium to high (stock market volatility)

- Earnings Potential: Moderate (3%-6% dividend yield on average)

- Time to See Returns: Quarterly

- Maintenance: Low (occasional portfolio monitoring)

Dividends are especially appealing because you don’t need to sell your stock to make money. Additionally, many companies offer dividend reinvestment plans (DRIPs), which allow you to automatically reinvest dividends to buy more shares, compounding your returns over time.

2. Real Estate Crowdfunding

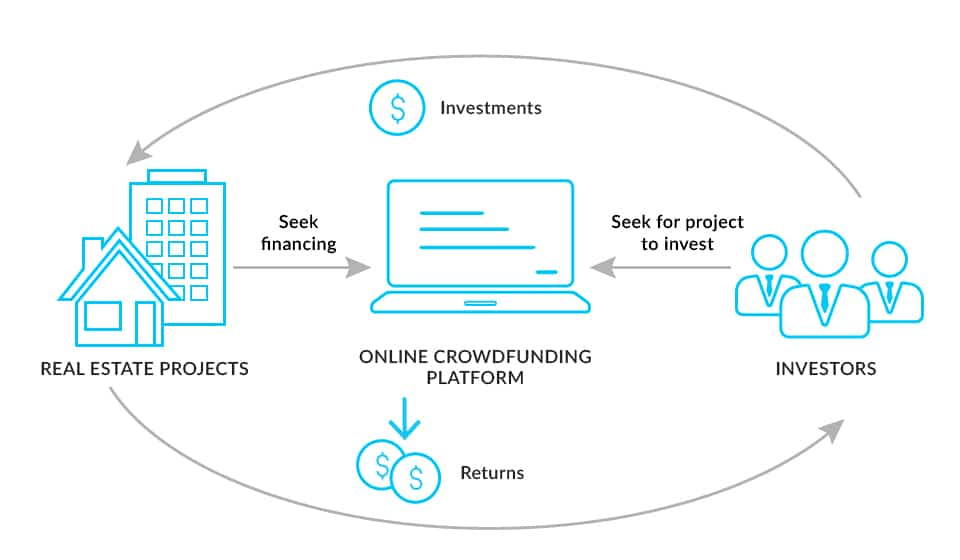

Real estate crowdfunding platforms allow you to invest in real estate projects without the need to buy a property outright.

By pooling funds with other investors, you can own a share of a real estate project, whether it’s a commercial building or residential development. This provides a way to earn passive income from rental yields and property appreciation.

- Initial Investment Required: Low to moderate (often starts at $500-$1,000)

- Risk Level: Medium (depends on the market and project)

- Earnings Potential: Moderate to high (5%-12% returns annually)

- Time to See Returns: Typically 6-12 months

- Maintenance: Low (platform handles management)

Crowdfunding platforms like Fundrise or RealtyMogul simplify the process, allowing you to diversify your real estate investments with minimal effort.

3. Peer-to-Peer Lending

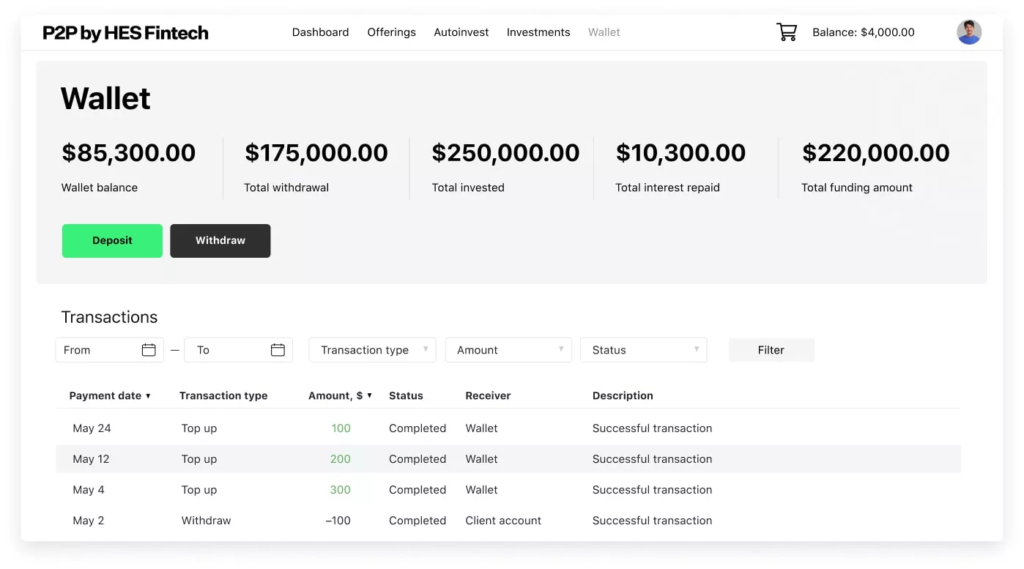

Peer-to-peer (P2P) lending platforms connect investors with borrowers. As a lender, you can provide loans to individuals or small businesses and earn interest on your investment.

The interest payments act as your passive income.

- Initial Investment Required: Low (can start with $25-$100 per loan)

- Risk Level: Medium to high (default risk from borrowers)

- Earnings Potential: Moderate (6%-10% annual returns)

- Time to See Returns: Monthly (depending on loan terms)

- Maintenance: Low (platform handles transactions)

Platforms like LendingClub or Prosper make it easy to start, and you can diversify your portfolio by lending to multiple borrowers to mitigate risk.

4. Rental Properties

Owning rental properties can generate consistent, long-term passive income through monthly rent. However, it requires a larger upfront investment and more hands-on management compared to other options. You can manage the property yourself or hire a property manager to handle tenant relations, repairs, and upkeep.

- Initial Investment Required: High (requires down payment on property)

- Risk Level: Medium (tenant defaults, property damage)

- Earnings Potential: High (depending on location and demand)

- Time to See Returns: Immediately (monthly rent)

- Maintenance: Medium (can be high without a property manager)

With rental income, you not only benefit from cash flow but also potential appreciation in property value over time.

5. Create an Online Course

If you have expertise in a specific field, creating an online course can be an excellent way to generate passive income. Platforms like Udemy, Teachable, or Skillshare allow you to create and sell courses on topics you’re knowledgeable about.

Once created, your course can be sold repeatedly, generating passive income each time a student enrolls.

- Initial Investment Required: Low (cost of equipment and time)

- Risk Level: Low (your course’s success depends on demand)

- Earnings Potential: Moderate to high (depending on the course price and demand)

- Time to See Returns: Immediately (once the course is live)

- Maintenance: Low (occasional updates and marketing)

The key is to choose a topic that has lasting demand and continuously market your course through social media or email lists.

6. Affiliate Marketing

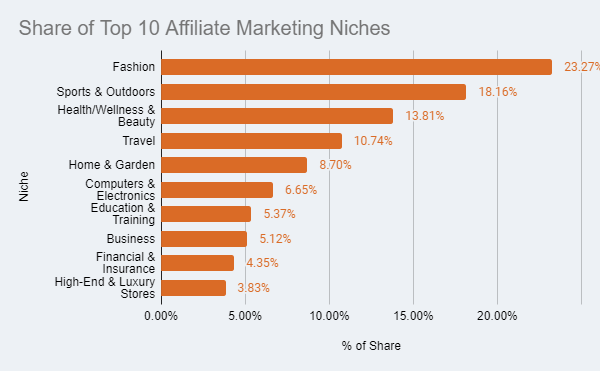

Affiliate marketing allows you to earn commissions by promoting other people’s products or services. You can include affiliate links on your blog, YouTube channel, or social media, and whenever someone makes a purchase through your link, you earn a percentage of the sale.

- Initial Investment Required: Low (just a website or social media presence)

- Risk Level: Low

- Earnings Potential: Moderate to high (depending on traffic and audience size)

- Time to See Returns: Varies (depends on audience engagement)

- Maintenance: Low to moderate (requires regular promotion)

Affiliate marketing works well if you have a blog or social media following in a specific niche, such as tech, fashion, or fitness.

To succeed in affiliate marketing, I highly recommend John Thornhill’s Ambassador Course and the Super Affiliate System. Both provide comprehensive training on how to build an effective affiliate marketing business, with proven strategies for scaling your income. These programs are ideal for beginners and advanced marketers alike, offering step-by-step guidance to maximize your success.

7. Write an E-book

If you have a talent for writing, publishing an e-book can be a great way to earn passive income. Once written and published on platforms like Amazon Kindle or Google Books, your e-book can generate sales without much ongoing effort.

E-books are particularly lucrative if you write on a topic with a dedicated audience.

- Initial Investment Required: Low (just time and effort)

- Risk Level: Low

- Earnings Potential: Moderate (depends on pricing and demand)

- Time to See Returns: Immediately (after publication)

- Maintenance: Low (occasional updates or new editions)

You can promote your e-book through social media or your website to increase sales.

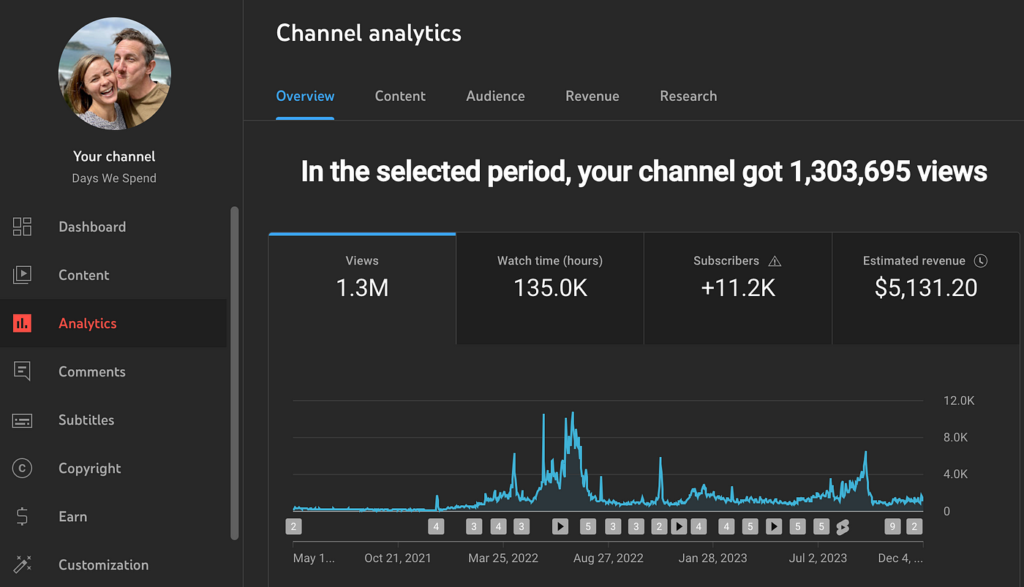

8. Create a YouTube Channel

YouTube offers several monetization options, including ad revenue, sponsored videos, and affiliate marketing. By creating valuable and engaging content, you can build a following and generate passive income as your videos attract more views over time.

Once you reach YouTube’s monetization threshold, you can earn through ads displayed on your videos.

- Initial Investment Required: Low (a camera and editing software)

- Risk Level: Low

- Earnings Potential: Moderate to high (depending on views and subscribers)

- Time to See Returns: 6–12 months (depending on growth)

- Maintenance: Medium (requires regular content creation)

Popular YouTubers often earn from multiple streams, including merchandise and sponsorship deals.

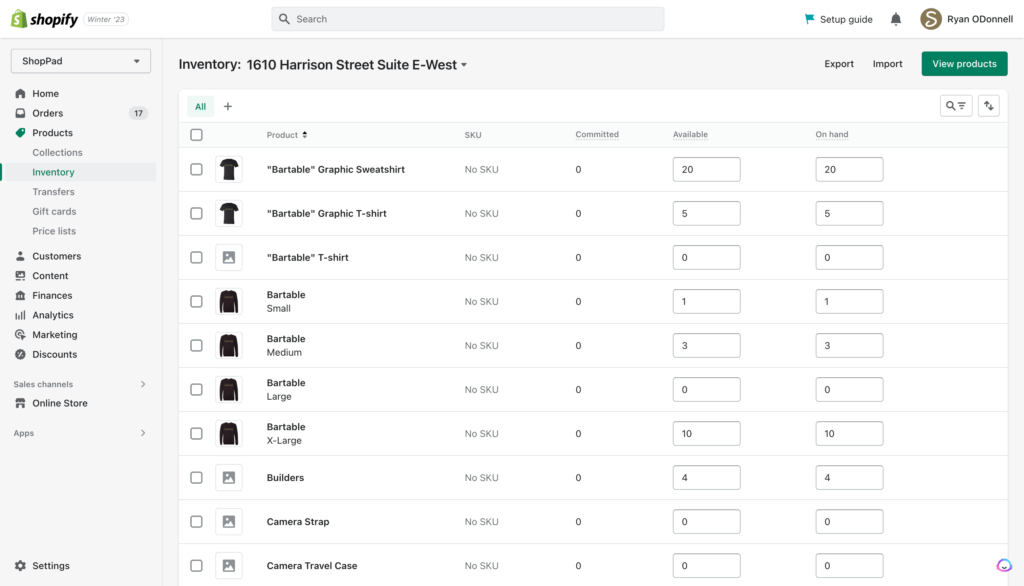

9. Automated Dropshipping Store

With dropshipping, you sell products online without holding inventory. When a customer makes a purchase, your supplier ships the product directly to them. Automation tools allow you to set up a store and automate most of the process, making this a low-maintenance way to earn passive income.

- Initial Investment Required: Low to moderate (for website setup and ads)

- Risk Level: Low to medium (depending on the market)

- Earnings Potential: Moderate to high (depending on niche)

- Time to See Returns: Immediately (once sales start)

- Maintenance: Low to moderate (marketing and customer service)

Platforms like Shopify and Oberlo make it easy to set up an automated dropshipping store.

10. High-Yield Savings Accounts & CDs

Although not as exciting as other methods, high-yield savings accounts and Certificates of Deposit (CDs) are reliable ways to earn passive income through interest. Many online banks offer better interest rates than traditional banks, allowing your money to grow passively.

- Initial Investment Required: Low to moderate (just deposit funds)

- Risk Level: Low (FDIC-insured accounts)

- Earnings Potential: Low (1%-4% annually)

- Time to See Returns: Monthly or annually (depends on account terms)

- Maintenance: None

This option is best for risk-averse individuals looking for steady, low-effort growth.

Conclusion: Start Building Your Passive Income in 2024

In 2024, finding the best ways to make passive income is all about aligning your skills, investment capacity, and risk tolerance with the right strategy. From low-risk options like high-yield savings accounts to more dynamic opportunities like real estate crowdfunding and affiliate marketing, there’s no shortage of ways to start generating income with minimal ongoing effort.

The key is to get started. Whether you’re looking to diversify your income streams, plan for retirement, or create financial security, passive income can help you achieve these goals over time. Start small, reinvest your earnings, and gradually scale up as you find what works best for you.

As you explore these methods, remember that consistency is crucial. Some income streams may take time to grow, while others might generate quick returns. The beauty of passive income lies in its compounding effect—once set up, these streams can continue to bring in revenue, even when you’re not actively involved.

Now is the perfect time to begin building your financial future. Whether you choose to invest in dividend stocks, launch a YouTube channel, or explore real estate crowdfunding, the opportunities for passive income are vast and varied. With the right strategy and persistence, you can start earning money while you sleep in 2024 and beyond.

Next Steps:

- Pick one or two passive income methods that suit your goals.

- Begin small and test the waters before making larger commitments.

- Stay informed and regularly evaluate your income streams for growth potential.

By starting today, you’ll be on the path to financial freedom through passive income!

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!