In today’s digital age, finding ways to make passive money has become a goal for many looking to achieve financial freedom. Imagine earning income without daily effort, freeing up your time to pursue passions, travel, or simply relax.

While building passive income streams requires some initial work, the right approach can lead to ongoing earnings with minimal upkeep. In this guide, we’ll explore ten proven ways to generate passive money, from investing in stocks to leveraging online platforms, helping you start earning even while you sleep.

Table of Contents

1. Dividend Stocks

Dividend stocks are a classic passive income method that allows you to earn consistent income simply by owning shares in reputable companies. These companies pay out a portion of their earnings as dividends to shareholders. It’s a low-effort way to make passive money, especially if you invest in stable companies with a track record of paying dividends.

- Initial Investment Required: Medium to high (depends on how much you want to invest)

- Risk Level: Moderate (stock market volatility)

- Maintenance: Minimal; occasional monitoring of the stock’s performance

Pro Tip: Reinvest your dividends through a dividend reinvestment plan (DRIP) to compound your returns over time.

2. Real Estate Investment Trusts (REITs)

For those interested in real estate but not ready for the responsibilities of property ownership, Real Estate Investment Trusts (REITs) are a practical alternative. REITs are companies that own, operate, or finance income-generating real estate. By purchasing shares in a REIT, you can earn dividends from real estate income without managing properties.

- Initial Investment Required: Low to medium

- Risk Level: Moderate (subject to real estate market)

- Maintenance: None; REITs are managed by professionals

Pro Tip: Look for REITs with a strong portfolio in high-demand sectors like healthcare, industrial, or technology real estate to minimize risks.

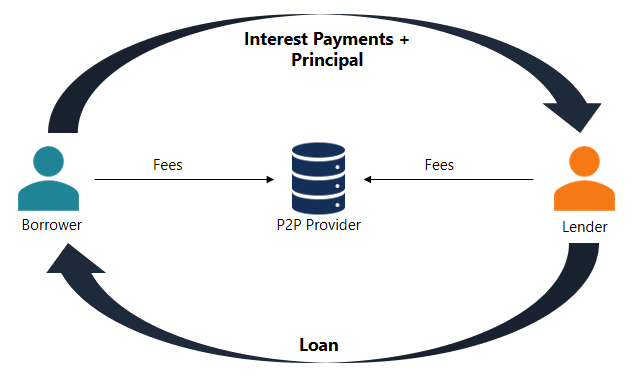

3. Peer-to-Peer Lending

Peer-to-peer (P2P) lending platforms let you lend money to individuals or small businesses, with the expectation of earning interest. You act as the lender, and as the borrowers repay, you earn back your principal with interest.

- Initial Investment Required: Low (many platforms allow small minimum investments)

- Risk Level: Moderate to high (depending on borrower’s creditworthiness)

- Maintenance: Minimal; regular updates on borrower repayments

Pro Tip: Diversify across multiple loans to reduce risk. Many platforms offer automated options to make it easier to manage a diverse portfolio.

4. High-Yield Savings Accounts and CDs

While interest rates may not be high, putting your money in high-yield savings accounts or certificates of deposit (CDs) can offer a stable and virtually risk-free way to make passive money. Many online banks provide competitive rates, and with CDs, you can lock in a rate for a specific term.

- Initial Investment Required: Low to medium

- Risk Level: Very low

- Maintenance: None; the account grows passively with interest

Pro Tip: Use a CD laddering strategy to maximize flexibility and access to funds at various intervals.

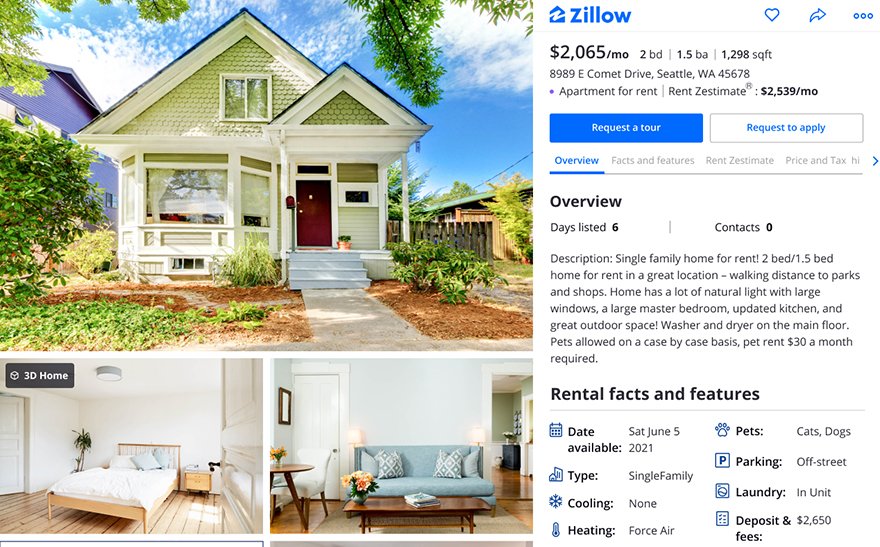

5. Rental Properties

Owning rental properties can provide a steady stream of income with relatively minimal ongoing effort. While the initial setup is labor-intensive (finding properties, tenants, etc.), rental properties can generate passive money once rented.

- Initial Investment Required: High (for property purchase)

- Risk Level: Moderate (depending on property location, tenant reliability)

- Maintenance: Moderate to high; ongoing property upkeep or property management costs

Pro Tip: Consider hiring a property management company to handle maintenance and tenant issues if you’re looking for a hands-off experience.

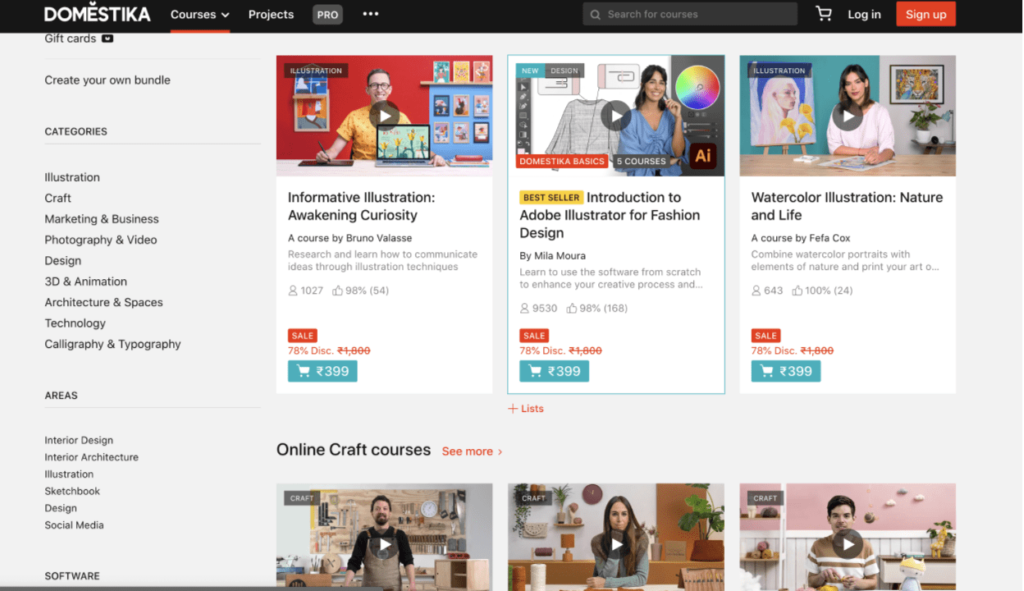

6. Create and Sell Online Courses

If you have expertise in a particular area, creating an online course can be a great way to generate passive income. Platforms like Udemy and Teachable let you create, publish, and market your course, allowing you to earn passive money as students enroll.

- Initial Investment Required: Low (mainly time to create content)

- Risk Level: Low to moderate (based on course demand)

- Maintenance: Occasional updates; mostly hands-off

Pro Tip: Focus on in-demand topics and update content periodically to keep it relevant and attract more students.

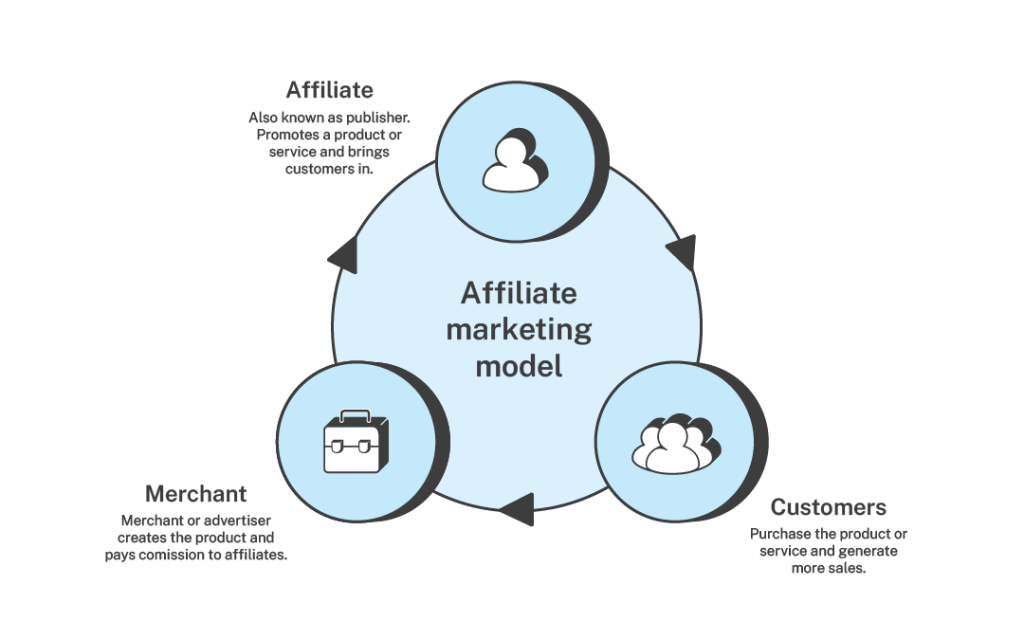

7. Affiliate Marketing

Affiliate marketing involves promoting products or services from other companies and earning a commission on sales generated through your referral links. Blogging, social media, and YouTube are popular platforms for affiliate marketing.

- Initial Investment Required: Low (content creation tools)

- Risk Level: Low to moderate (based on product or audience)

- Maintenance: Regular updates to content for relevance

Pro Tip: Choose products that align with your niche and provide real value to your audience to build trust and increase conversions.

8. Royalties from Creative Works

If you’re a creative — musician, writer, or artist — licensing your work can generate ongoing royalties. Platforms like Amazon Kindle, Spotify, or even Shutterstock allow you to earn passive money every time someone downloads or purchases your work.

- Initial Investment Required: Low (cost of production)

- Risk Level: Low to moderate (demand for the content)

- Maintenance: Minimal; occasional content refresh

Pro Tip: Leverage multiple platforms to increase exposure and revenue.

9. Print-on-Demand (POD)

POD allows you to design custom merchandise (like T-shirts or mugs) and sell them through platforms like Redbubble or Printful. The platform handles production, shipping, and customer service, making it a passive income stream after the initial design work.

- Initial Investment Required: Low

- Risk Level: Low

- Maintenance: None; designs sell on autopilot

Pro Tip: Create designs around trending topics or evergreen themes to maximize visibility and sales.

10. Automated Dropshipping Stores

With dropshipping, you can sell products without managing inventory. An automated dropshipping store allows you to sell items directly to customers, and your suppliers handle packaging and shipping. Automated tools help run the store with minimal involvement.

- Initial Investment Required: Medium

- Risk Level: Moderate (due to market competition)

- Maintenance: Low; mostly managed by software

Pro Tip: Focus on niche products and use SEO or social media ads to drive traffic to your store.

Conclusion

Generating passive money is not only possible; it’s a powerful way to build long-term financial stability and freedom. The ten methods we’ve explored offer various pathways, from investing in stocks and real estate to leveraging online platforms for creating and selling digital products. Whether you’re looking for low-risk options like high-yield savings or more ambitious ventures like rental properties, there’s something here for everyone.

The key to successful passive income is choosing strategies that align with your resources, goals, and lifestyle. Start with one or two methods that resonate with you, invest the necessary time and effort upfront, and watch as your passive income streams grow with minimal ongoing effort. While some patience is required, the potential rewards make the journey worthwhile.

Ultimately, building passive money streams can empower you to enjoy financial security and freedom, freeing up your time for the things you love. So, take that first step today, and start creating income that works for you, even while you sleep!

Ready to Start Earning Passive Income? Join Our Free Webinar!

Join this FREE Webinar Workshop and learn the top strategies for making passive money in 2024! In this live session, you’ll get expert tips on setting up income streams that work for you with minimal effort. Spots are limited, so save your seat now and take the first step towards financial freedom

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!