Crypto trading has opened up new investment opportunities for people around the world, offering both beginners and seasoned traders a chance to participate in the digital economy. But with hundreds of platforms to choose from, how do you find the one that best fits your trading style and goals?

In this guide, we’ll break down everything you need to know about crypto trading strategies, platform features, and security essentials. By the end, you’ll have a clear understanding of what to look for when choosing the best platform for your unique needs in the fast-paced world of crypto trading.

Table of Contents

Introduction to Crypto Trading

Crypto trading allows individuals to trade digital currencies like Bitcoin, Ethereum, and many others. Unlike traditional assets, cryptocurrencies operate on decentralized networks, which offer a level of flexibility but also come with volatility and risk.

This decentralized nature means that crypto is less affected by centralized authorities, but prices can fluctuate dramatically, creating opportunities for profit — and loss. Choosing the right platform can make all the difference in managing these risks and capitalizing on these opportunities.

Types of Crypto Trading Strategies

Each trader may have a unique approach depending on their risk tolerance, time commitment, and experience level. Here are the most common strategies and how they influence platform choice:

- Day Trading: Involves making multiple trades within a day to benefit from short-term price movements. Ideal Platforms: Look for platforms with low transaction fees and robust charting tools.

- Swing Trading: Traders hold onto assets for several days or weeks, aiming to capitalize on larger price shifts. Ideal Platforms: Choose platforms with advanced analytics and indicators to study market trends.

- HODLing (Long-Term Holding): This approach involves holding assets for months or years, betting on long-term appreciation. Ideal Platforms: Focus on secure platforms with strong custodial features and minimal holding fees.

- Algorithmic Trading: Utilizes automated trading algorithms and bots. Ideal Platforms: Seek platforms with API integration for bot support and real-time trading data.

Comparing the Top Crypto Trading Platforms

Not all crypto trading platforms are built the same. Below are some of the most popular platforms and their distinct features:

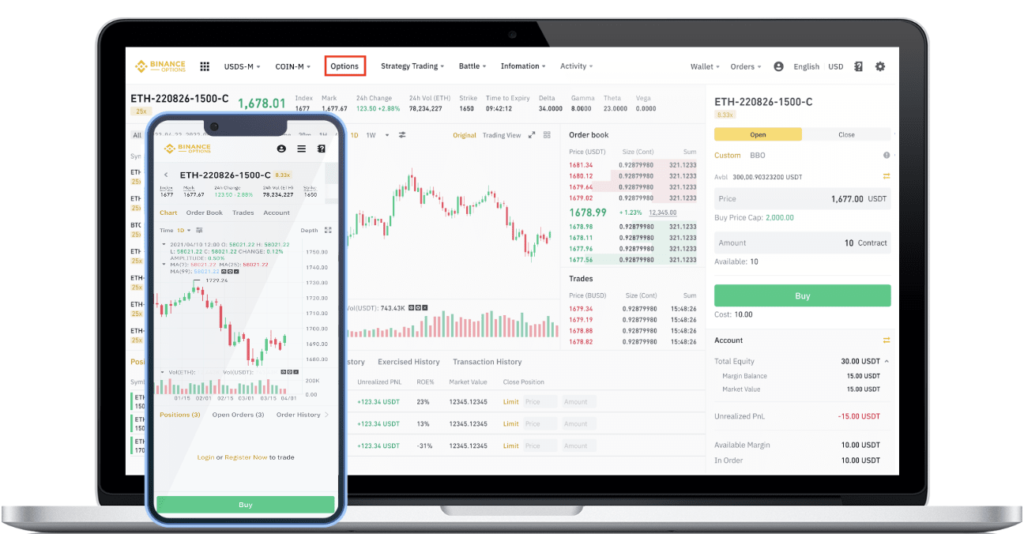

- Binance: Known for a wide selection of cryptocurrencies and competitive fees. It’s popular among day traders and supports various advanced trading options.

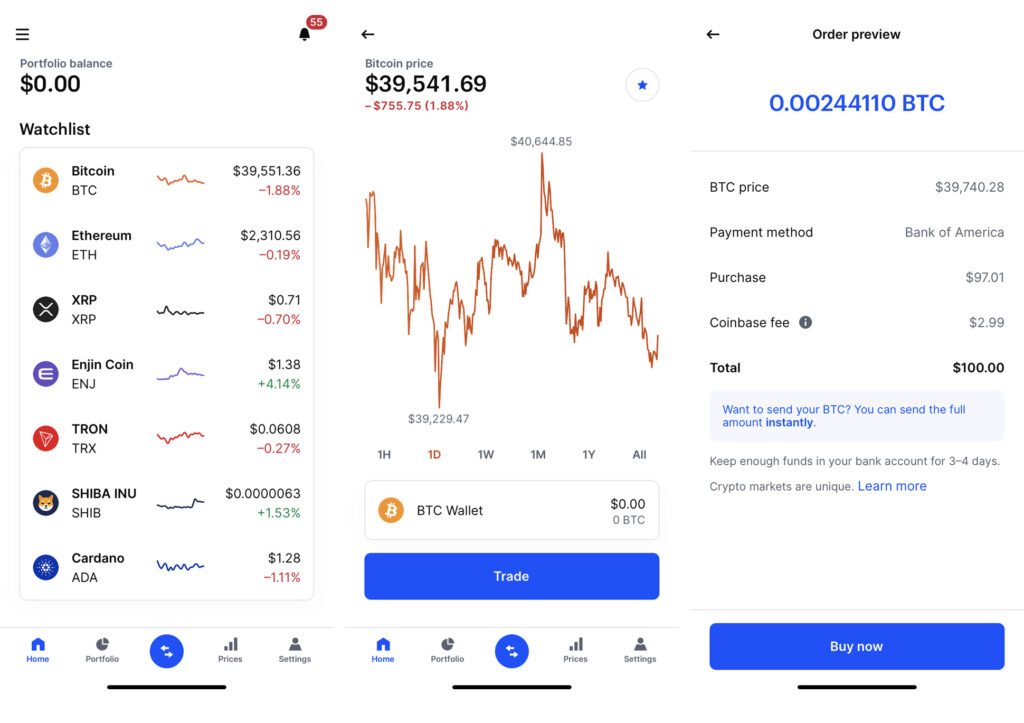

- Coinbase: Highly beginner-friendly with a simple interface, making it ideal for new investors. It’s also a regulated platform with high security.

- Kraken: Offers more advanced trading options and strong security features, catering to both beginners and experienced traders.

When choosing a platform, it’s essential to look for a mix of security, ease of use, and the specific tools that align with your trading style.

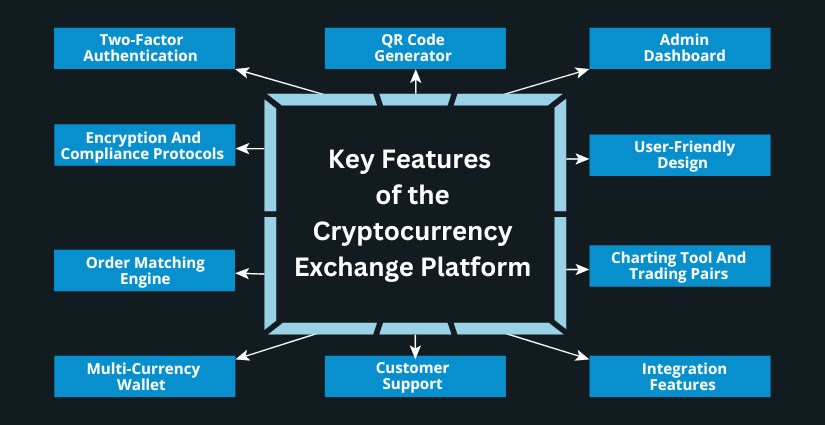

Essential Crypto Trading Tools and Features

The right platform will provide a range of tools that make trading smoother and more efficient. Key tools to look out for include:

- Advanced Charting Tools: Platforms like Binance and TradingView offer detailed charting capabilities with custom indicators to help traders analyze price movements.

- Order Types: Look for stop-loss, limit orders, and other flexible options to control your trades effectively.

- API Support: For algorithmic trading, API access is crucial to enable seamless bot integration.

- Leverage Options: Some platforms offer leverage trading, allowing traders to borrow funds to amplify potential profits. Note that leverage increases risk, so it’s best suited for experienced traders.

Fees and Costs in Crypto Trading

Fees can quickly cut into profits, so it’s important to compare transaction costs across platforms. Here are the primary types of fees:

- Transaction Fees: Most platforms charge a small percentage per trade, typically ranging from 0.1% to 1%.

- Deposit and Withdrawal Fees: Some platforms charge for transferring funds to and from your account.

- Spread Costs: Some platforms charge a spread fee, meaning you pay a premium on the market price.

Platforms like Binance and KuCoin are known for low fees, whereas more user-friendly platforms like Coinbase tend to charge higher fees.

Security Features to Protect Your Assets

Security is paramount in crypto trading. Here are critical security features to look for:

- Two-Factor Authentication (2FA): Provides an extra layer of security, ensuring only you can access your account.

- Cold Storage: Some platforms keep a portion of funds offline to protect them from hackers.

- Insurance: Platforms like Gemini offer insurance against theft or hacking, adding peace of mind for traders.

User Experience and Platform Interface

User experience can make or break a platform. Beginner-friendly interfaces, like those offered by Coinbase, are often less intimidating for newcomers, while advanced traders may prefer the robust tools available on Binance or Kraken.

- Beginners: Look for intuitive interfaces with clear instructions and easy navigation.

- Advanced Users: Seek platforms with customizable dashboards, advanced charting options, and API access.

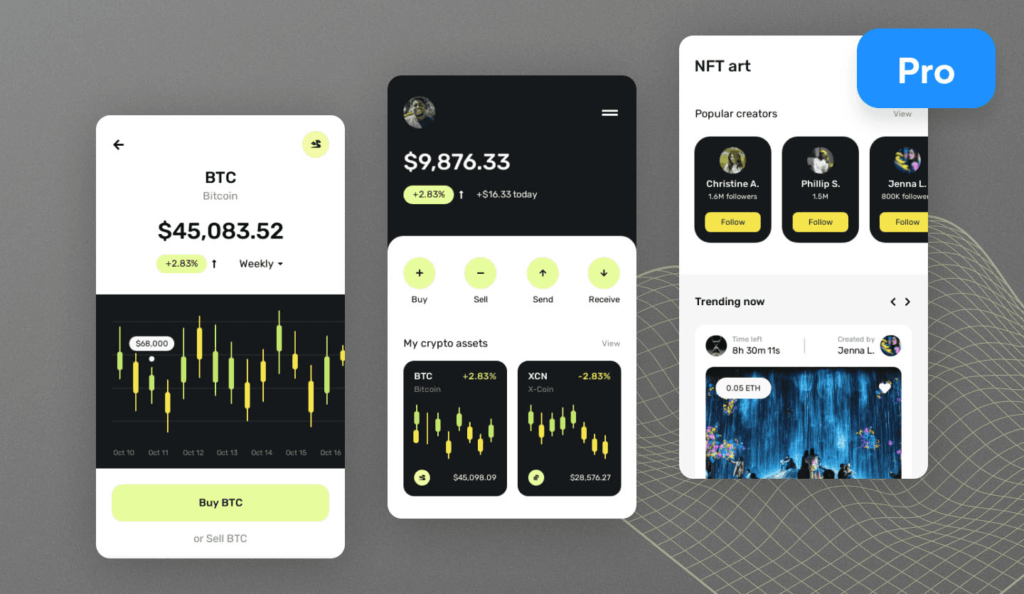

Mobile Trading Options

With the crypto market open 24/7, having access to a reliable mobile app is essential for traders who want to monitor their assets and make quick decisions on the go. Here are some features to look for in a mobile trading app:

- Real-Time Price Alerts: Get instant notifications about price changes to react quickly to market shifts.

- Full Trading Functionality: Ensure the app allows you to execute trades, set stop-loss and limit orders, and access your full portfolio.

- User-Friendly Interface: A clean, intuitive layout that’s easy to navigate, even for beginners.

- Advanced Charting Tools: Access to basic charting tools on mobile can be helpful for analysis without needing a computer.

- Security Features: Look for two-factor authentication (2FA) and biometric login options for added security on mobile.

- Cross-Device Sync: Seamless integration between the mobile app and desktop version to access your trades and settings from anywhere.

- Responsive Customer Support: In-app customer support options, like live chat or support tickets, are especially useful when you’re trading on the go.

Platforms like Binance, Kraken, and Coinbase offer well-rated mobile apps that include these essential features, giving traders the flexibility to manage their crypto portfolios anytime, anywhere.

Customer Support and Community Resources

Crypto trading can be complex, so reliable customer support is a must. Leading platforms often provide 24/7 support, while others may rely on online resources or community forums.

- 24/7 Support: Platforms like Kraken provide round-the-clock support via chat or email.

- Community Resources: Many platforms have active forums or communities where traders share tips, troubleshoot issues, and exchange insights.

Supported Cryptocurrencies

The variety of cryptocurrencies supported on a platform can impact your strategy. While platforms like Binance and KuCoin support hundreds of coins, others like Coinbase may focus on major cryptocurrencies only.

If you plan on trading niche coins, ensure your platform supports them. For major coins, any mainstream platform should suffice.

Conclusion: Choosing the Right Platform for Your Crypto Trading Journey

In the dynamic world of crypto trading, selecting the right platform is essential for aligning your trading strategy with your goals. Whether you’re a beginner eager to explore the crypto market or an experienced trader looking for advanced tools, the platform you choose can significantly impact your success.

By considering factors such as fees, security features, supported cryptocurrencies, and the tools available, you can find a platform that suits your trading style—whether you prefer short-term, high-frequency trades or long-term investments.

Remember, there’s no one-size-fits-all platform. Each trader has unique needs and preferences, and it’s important to take the time to assess which platform will support your strategy effectively. As you gain more experience, you may even choose to diversify across multiple platforms to take advantage of different features and trading opportunities.

Ultimately, crypto trading is about finding the right balance of risk, reward, and security. With the right platform, you’ll be equipped to make informed decisions and optimize your trading journey.

Happy trading, and may your investments flourish in the exciting world of crypto!

Ready to take your crypto trading skills to the next level?

Join this free, live webinar workshop where industry experts will walk you through proven strategies, platform features, and tools to maximize your trading success!

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!