Cryptocurrency trading strategy is the cornerstone of success in the volatile world of digital assets. Without a clear plan, even the most experienced traders can fall victim to impulsive decisions and market swings. In this guide, we’ll break down the essential tips, tools, and techniques you need to create a winning strategy. Whether you’re just starting or looking to refine your approach, this comprehensive guide will help you navigate the crypto market with confidence and maximize your trading potential. Let’s dive in!

Table of Contents

What is a Cryptocurrency Trading Strategy?

A cryptocurrency trading strategy is a systematic plan that traders use to make decisions about buying, selling, and holding digital assets. It’s based on analysis, risk tolerance, and market trends, designed to improve the consistency of results over time.

Whether you’re looking to trade Bitcoin, Ethereum, or altcoins, having a strategy helps you avoid impulsive decisions driven by fear or greed. A well-executed strategy not only boosts your chances of profit but also reduces unnecessary losses.

Why You Need a Cryptocurrency Trading Strategy

- Manage Risk Effectively:

A trading strategy allows you to set clear rules for stop-loss and take-profit levels, reducing emotional trading. - Informed Decision-Making:

Strategies help traders rely on data and analysis instead of gut feelings or market hype. - Consistency Over Time:

Without a plan, it’s easy to chase trends and lose focus. A strategy ensures long-term consistency.

Top Cryptocurrency Trading Strategies

1. Scalping

- What it is:

Scalping involves making numerous small trades throughout the day, aiming to profit from tiny price changes. - Who it’s for:

Traders with time to monitor the market constantly and execute trades quickly. - Tips:

- Use low-fee exchanges to avoid high transaction costs.

- Focus on highly liquid cryptocurrencies like Bitcoin or Ethereum.

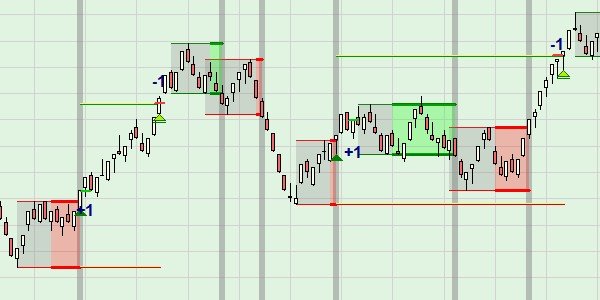

2. Day Trading

- What it is:

Day trading involves opening and closing positions within the same day to capitalize on intraday price movements. - Who it’s for:

Experienced traders familiar with technical analysis and market patterns. - Tips:

- Use tools like candlestick charts and moving averages to identify entry and exit points.

- Avoid over-leveraging to manage risks.

3. Swing Trading

- What it is:

This medium-term strategy involves holding positions for days or weeks to capture larger price movements. - Who it’s for:

Traders with patience and a willingness to analyze market trends. - Tips:

- Look for trends using the Relative Strength Index (RSI) and Bollinger Bands.

- Combine fundamental and technical analysis for better predictions.

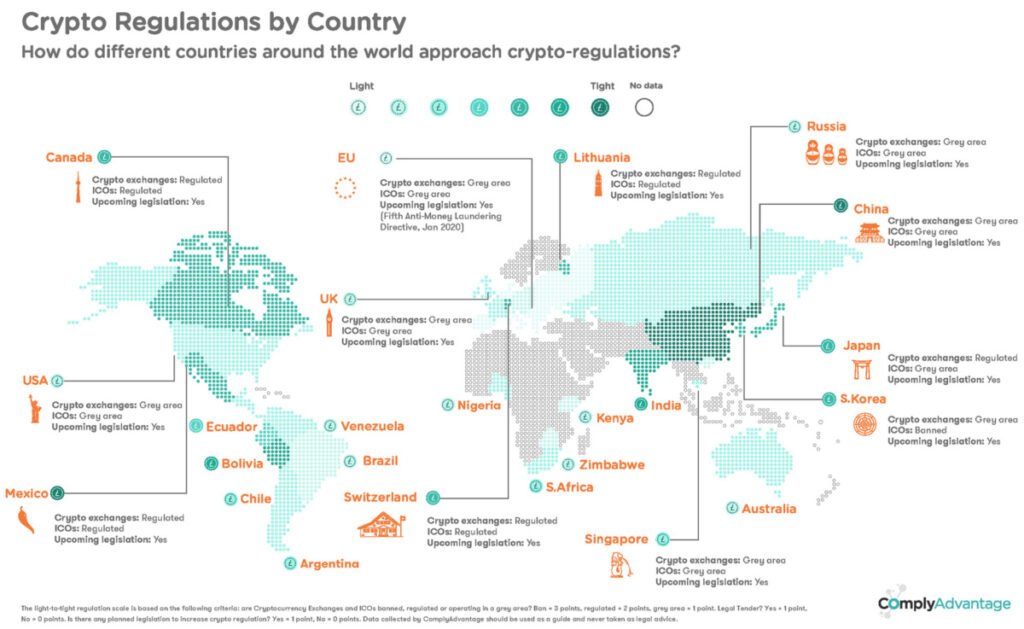

4. Arbitrage

- What it is:

Buying cryptocurrency on one exchange at a lower price and selling it on another at a higher price. - Who it’s for:

Traders who can act fast and have access to multiple exchanges. - Tips:

- Ensure transfer times between exchanges are quick.

- Factor in fees and spreads to calculate true profitability.

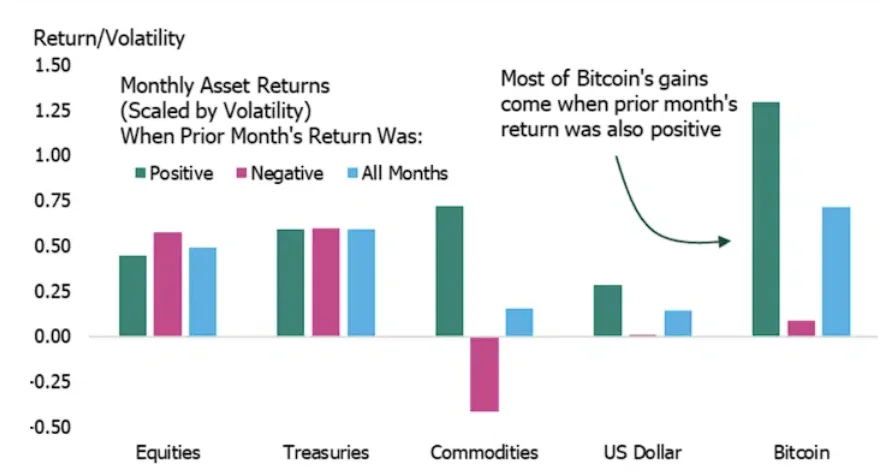

5. HODLing (Hold On for Dear Life)

- What it is:

A long-term strategy where investors buy and hold assets regardless of short-term price fluctuations. - Who it’s for:

Investors with strong belief in cryptocurrency’s future value. - Tips:

- Diversify your holdings to mitigate risks.

- Only invest what you can afford to lose.

Essential Tools for Cryptocurrency Trading

1. Trading Platforms

- Examples: Binance, Coinbase, Kraken.

- Features to consider: low fees, user-friendly interface, security measures.

2. Charting Tools

- Examples: TradingView, Coinigy.

- Use them to analyze historical price data and identify trends.

3. Portfolio Management Tools

- Examples: CoinStats, Delta.

- Track your investments and calculate profit/loss in real-time.

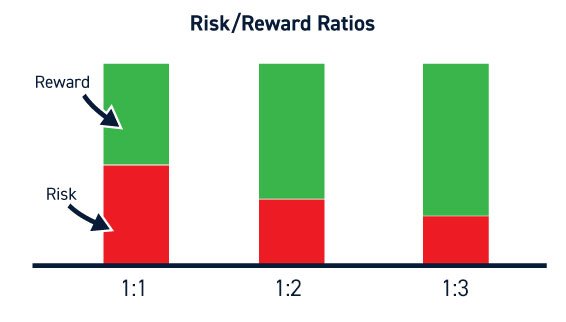

Risk Management Tips

- Set Stop-Loss and Take-Profit Levels:

Define how much you’re willing to lose or gain before exiting a trade. - Diversify Your Portfolio:

Avoid putting all your funds into a single cryptocurrency. - Understand Leverage Risks:

Trading with borrowed funds can amplify both gains and losses.

Common Mistakes to Avoid

- Overtrading:

Making too many trades often leads to higher losses. - Ignoring Research:

Blindly following trends without understanding the market is a recipe for disaster. - Falling for Scams:

Beware of Ponzi schemes, fake coins, and phishing attacks.

Conclusion: Start Trading Smarter with a Solid Strategy

The world of cryptocurrency trading is filled with opportunities, but it also comes with its share of risks. A well-crafted cryptocurrency trading strategy is your key to navigating the volatile market confidently and effectively. Whether you’re a beginner exploring strategies like HODLing or an advanced trader using techniques like scalping and arbitrage, the foundation of success lies in discipline, continuous learning, and proper risk management.

Remember, no strategy guarantees profits, but a structured approach significantly improves your chances of long-term success. Use the tools and techniques discussed in this guide to analyze the market, make informed decisions, and refine your strategy over time.

Take Action Today:

- Start by identifying your trading goals and risk tolerance.

- Choose a strategy that aligns with your experience and time commitment.

- Leverage the tools available to make data-driven decisions.

The cryptocurrency market rewards those who are prepared and patient. So, dive in, stay consistent, and always keep learning. Your journey to successful trading begins now!

Unlock the Secrets to 150x Gains in the Crypto Bull Market!

Ready to take your crypto trading to the next level? Join our FREE Crypto Workshop and discover the proven strategies that have helped traders achieve 150x gains during bull markets.

🔑 What You’ll Learn:

✅ How to identify the next big opportunities in the crypto market.

✅ Proven trading strategies to maximize profits.

✅ Expert insights to capitalize on the current bull market trends.

👉 Register for the Free Webinar Here

Affiliate Disclaimer: Some of the links in this article are affiliate links, which means I may earn a commission if you click on the link and make a purchase. Please note that I only recommend products or services that I genuinely believe in and have personally experienced. Your purchase helps support my work in providing valuable content to readers like you. Thank you for your support!